Cameco Stock: Analyzing Current Trends and Future Outlook

Introduction to Cameco Corporation

Cameco Corporation, headquartered in Saskatoon, Saskatchewan, is one of the largest uranium producers in the world. As a key player in the nuclear power industry, Cameco’s stock is of significant interest to investors as the demand for clean energy continues to rise globally. In the wake of heightened interest in nuclear energy and its role in mitigating climate change, Cameco stock has garnered considerable attention from both institutional and retail investors alike.

Current Market Trends

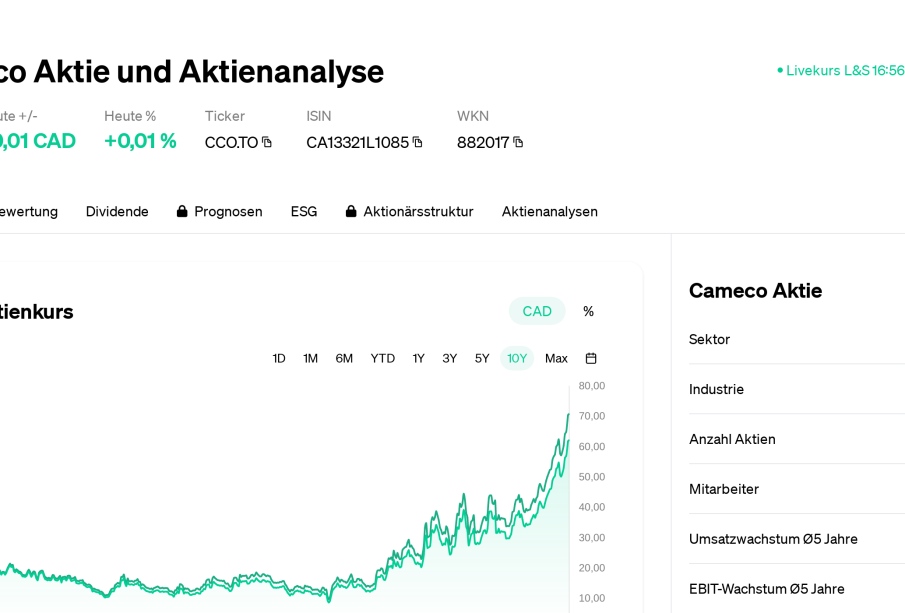

As of October 2023, Cameco stock has seen a notable uptick in its value, reflecting a broader shift in market sentiment towards uranium investments. The price of uranium has been on the rise, driven by supply chain disruptions and geopolitical tensions that have caused concerns about energy security. According to industry reports, uranium prices reached the highest levels in over a decade, with a spot price around USD 55 per pound. This surge has translated into heightened activity in Cameco’s stock, which has risen approximately 18% since the start of the year.

Recent Developments

Cameco has been proactive in responding to market changes. In September 2023, the company announced it was increasing production at its Cigar Lake operation, aiming to meet the growing demands from global markets. Additionally, Cameco has entered various long-term supply agreements with utilities, indicating strong confidence in future market conditions. Analysts also highlight Cameco’s strategic safeguarding of over 26 million pounds of uranium for future sales. This forward-looking measure positions the company favorably as supply shortages become more pronounced.

Investment Analysis

Investment analysts are divided on Cameco’s stock outlook. Some view it as a strong buy, citing the resurgence of nuclear energy, particularly in countries like China and India where energy needs are skyrocketing. However, others express caution given the inherent risks associated with nuclear energy and fluctuations in uranium prices. A report by Goldman Sachs outlines that while Cameco stock is currently undervalued compared to its peers, volatility remains a concern, and investors should weigh the risks accordingly.

Conclusion and Future Outlook

In conclusion, Cameco stock presents a compelling opportunity amidst the growing global focus on sustainable energy. While the recent uptick signals investor optimism, potential volatility remains a significant factor to consider. Moving forward, investors are encouraged to keep an eye on changes in uranium prices, global energy policies, and Cameco’s performance relative to its production targets. The future could be bright for Cameco, but as with any investment, thorough research and cautious optimism are advised.