Understanding CRWD Stock: Trends and Insights for Investors

Introduction

As the digital landscape continues to evolve, cybersecurity has become increasingly essential for businesses and individuals alike. CrowdStrike (CRWD), a prominent player in the cybersecurity sector, has garnered investor attention due to its robust growth and innovative solutions. Understanding the current trends surrounding CRWD stock is critical for potential investors seeking to navigate the complexities of the stock market.

Current Performance

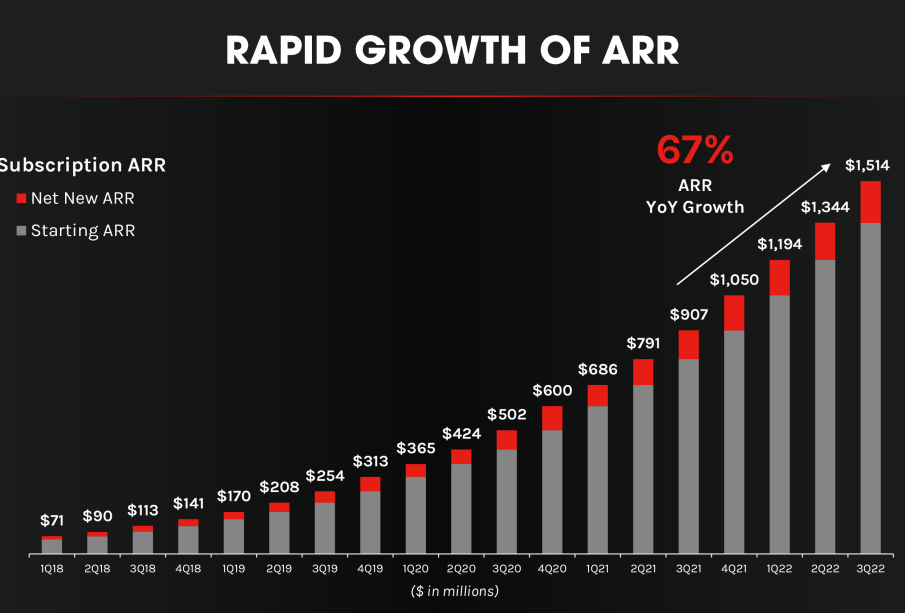

As of October 2023, CRWD stock has shown significant resilience despite broader market fluctuations. The company’s recent earnings report highlighted a revenue increase of 20% year-over-year, surpassing analysts’ expectations. This growth has largely been attributed to an expansion in customer base and an uptick in demand for their cloud-native endpoint protection platform. Notably, CrowdStrike’s subscription revenue accounted for a dominant portion of its overall income, indicating a strong market position.

Moreover, CRWD stock has recently seen a price correction, which may present a unique buying opportunity for investors. According to market analysts, the potential for recovery is high, particularly given the increasing global focus on cybersecurity due to rising cyber threats.

Market Impact and Trends

The broader cybersecurity market has been projected to grow substantially, reaching over $300 billion by 2024. This growth trajectory indicates a favorable environment for companies like CrowdStrike. The rise in cyberattacks, notably ransomware incidents, has pushed both public and private sectors to invest heavily in cybersecurity solutions.

Investors should also note that CrowdStrike’s strategic partnerships, particularly with cloud service providers, are enhancing its competitive edge. The recent alliance with a leading cloud computing company to integrate their cybersecurity solutions has been viewed positively in the market, potentially boosting sales and visibility.

Conclusion

In summary, CRWD stock represents a compelling option for investors looking to enter the rapidly growing cybersecurity market. With solid financial performance, a strong focus on innovation, and a favorable market environment, CrowdStrike appears well-positioned for continued growth. Nevertheless, as with any investment, potential investors should conduct thorough research and consider market conditions before making decisions.

The outlook for CRWD stock is optimistic, yet it emphasizes the importance of monitoring market developments and the company’s strategic initiatives that may influence future stock performance.