Understanding Current Mortgage Rates in Canada

The Importance of Mortgage Rates

Mortgage rates are crucial in the real estate market, significantly affecting homebuyers and the housing sector’s overall health. As of late 2023, fluctuations in these rates have prompted discussions about affordability and market stability, especially with Canada’s housing market facing various economic pressures.

Current Mortgage Rate Trends

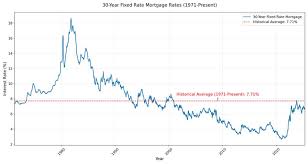

As of October 2023, mortgage rates in Canada have seen an upward trend due to the Bank of Canada’s efforts to combat inflation. According to the Bank of Canada, the average 5-year fixed mortgage rate hovers around 5.5%, while variable rates are slightly lower, focusing on the short-term market sentiments.

In the past several months, we have observed a gradual increase, primarily as the Bank of Canada raised its benchmark interest rates to 4.50%—a move designed to stabilize the economy during post-pandemic recovery. Economists predict that until inflation is firmly under control, mortgage rates may continue to rise or stabilize around these levels.

Impact on Homebuyers

This rise in mortgage rates has significant implications for prospective homebuyers. With higher borrowing costs, many are reevaluating their financial capabilities. The average monthly mortgage payment has increased, causing potential buyers to either adjust their budgets or postpone purchases altogether. As reported by the Canadian Real Estate Association, home sales have declined by approximately 15% compared to last year, as higher rates push first-time buyers out of the market.

Expectations Moving Forward

Looking to the future, financial analysts predict that mortgage rates may stabilize or even decline slightly if inflationary pressures ease. However, this will largely depend on global economic conditions and the Bank of Canada’s monetary policy decisions. Homebuyers are advised to remain vigilant, keep track of market trends, and consult with mortgage advisors to navigate these changes effectively.

Conclusion

In summary, understanding current mortgage rates is vital for anyone looking to enter the housing market in Canada. With ongoing fluctuations driven by economic factors, potential homebuyers need to stay informed and adapt to the changing landscape. The impact of mortgage rates not only affects individual buy decisions but also has broader implications for the Canadian economy and housing market stability.