Understanding Canada Interest Rates and Their Economic Impact

Introduction

Interest rates are a critical component of economic stability in Canada, influencing everything from consumer spending to business investment. As the Bank of Canada adjusts its policy rates, it affects the overall economy, mortgage rates, and inflation rates. Understanding the changes in interest rates is crucial for Canadians as they prepare for future financial decisions.

Current State of Canada’s Interest Rates

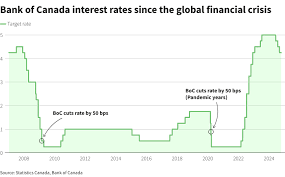

As of October 2023, the Bank of Canada has maintained its benchmark interest rate at 5.00%. This decision follows a series of aggressive hikes throughout 2022 aimed at combating soaring inflation, which peaked at 8.1% in June 2022, a stark increase from the previous year’s rate. The central bank’s approach reflects a balancing act between fostering economic growth and curbing inflation effectively.

The recent trend in interest rates signifies a cautious approach, as the bank weighs the impacts of potential economic downturns while committed to targeting inflation around 2%. Analysts have noted that keeping rates steady is intended to give the economy time to adjust to previous hikes, and potential shifts in global markets may still influence this rate moving forward.

Impact on Canadians

The current interest rates have several direct implications for Canadian households and businesses. With higher rates, borrowing costs have increased for mortgages and personal loans, leading to a cautious attitude among consumers. Many Canadians are now facing higher monthly payments, affecting their purchasing power.

The real estate market has also shown signs of slowing. With mortgage rates climbing, potential homebuyers may struggle to enter the market, while those with variable-rate mortgages experience increased financial pressure. According to a recent report from the Canadian Real Estate Association (CREA), the number of home sales fell by approximately 25% compared to last year, a clear indication of the impact of rising interest rates.

Looking Ahead

Economists predict that rates may remain stable for the foreseeable future. The Bank of Canada is likely to adopt a wait-and-see approach, assessing domestic economic indicators and global economic shifts. Factors such as ongoing labor market conditions, inflation trends, and geopolitical uncertainties will play pivotal roles in influencing potential rate adjustments.

Canadians are encouraged to monitor these developments closely, as any changes in the interest rate landscape can have real implications for their finances. Whether it’s considering a mortgage, investing in a business, or managing personal debt, the state of interest rates will continue to shape financial decisions across the country.

Conclusion

In conclusion, as Canada navigates its path through fluctuating interest rates, understanding the implications of these changes is essential for consumers and investors alike. While stability appears to be the focus, Canadians must remain vigilant in observing how these rates affect their economic realities and decisions in the coming months.