Understanding the Current Trends in TD Stock Price

Introduction

As one of Canada’s largest banks, Toronto-Dominion Bank (TD) has a significant presence in the financial markets. The TD stock price not only reflects the bank’s performance but also serves as a barometer for investor confidence in the banking sector overall. With recent economic fluctuations and interest rate changes, monitoring TD’s stock price is crucial for investors, analysts, and market enthusiasts alike.

Current Stock Performance

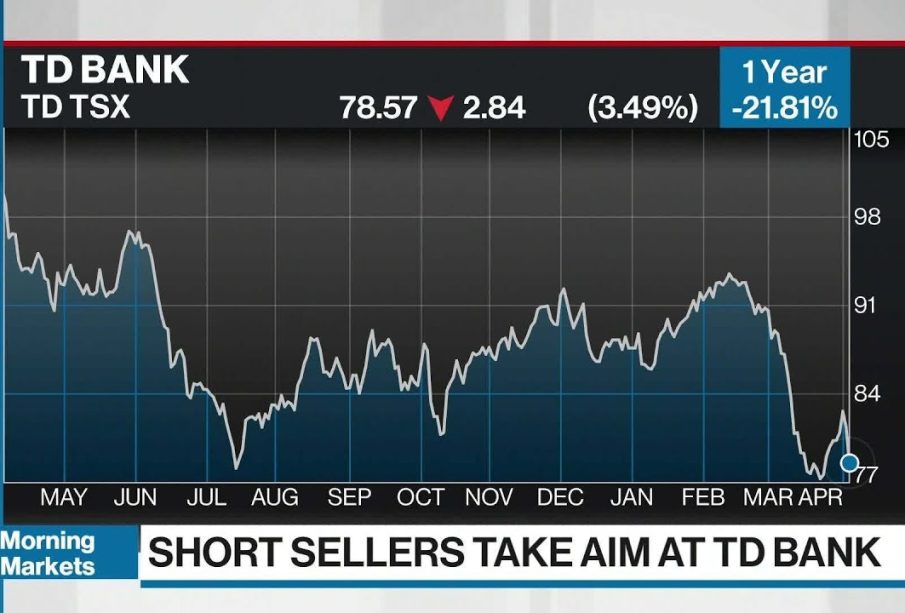

As of mid-October 2023, TD’s stock price has experienced notable volatility, trading around CAD 83 per share. Analysts have linked the fluctuations to several underlying factors, including changes in interest rates set by the Bank of Canada, global economic pressures, and the bank’s recent earnings reports.

Recent Developments Affecting TD Stock

TD Bank’s recent financial results, released last month, indicated growth in profits driven by increased lending and a strong performance in their wealth management division, despite facing challenges in the home mortgage sector due to rising interest rates. Additionally, the bank has announced strategic initiatives aimed at expanding their digital banking services, which investors view positively as a long-term growth opportunity.

However, fears surrounding inflation and potential recession following Bank of Canada’s recent interest rate hikes have led to cautious sentiment in the market. While TD stock witnessed a brief decline following these announcements, it has shown resilience, recovering as investors begin to absorb the bank’s solid financial health.

Market Trends and Forecasts

Stock analysts are closely watching TD’s ability to navigate the lingering effects of economic uncertainty. Projections for the next quarter suggest that if TD manages to sustain its credit quality and keep loan defaults at bay, its stock price could rebound, with some analysts forecasting a target price upwards of CAD 90 within the next six months.

Conclusion

The TD stock price remains a significant area of focus for those interested in Canadian equities. With ongoing developments in the banking sector, both domestic and internationally, investors should monitor TD’s performance closely. As interest rates fluctuate and the economy stabilizes, TD Bank could be well-positioned for growth, making its stock an intriguing option for future investment. Staying informed on these trends will be essential for anyone looking to navigate the complexities of the current financial landscape.