Current Trends and Future Predictions for AMC Stock

Introduction

AMC Entertainment Holdings, Inc. (AMC), once celebrated during the pandemic for becoming a favorite among retail investors, has remained a topic of great interest in the investment community. With its stock being highly volatile and widely discussed on social media platforms, understanding the factors influencing AMC stock is crucial for both investors and the market at large. In recent days, AMC has continued to capture attention, making it relevant to discuss its current trends, recent events, and future predictions.

Recent Performance and Market Sentiment

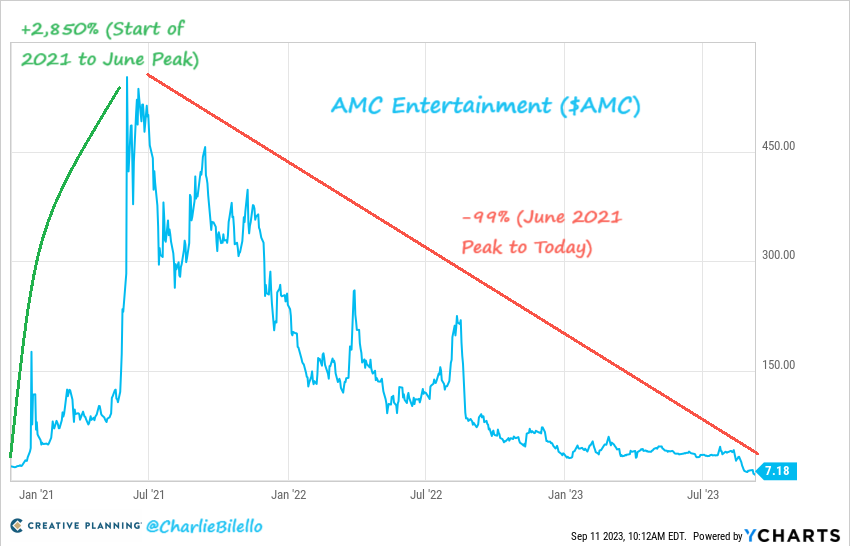

As of October 2023, AMC stock has experienced fluctuations, with a noted decrease over the past month as broader market trends have impacted growth stocks. The stock recently traded around $8, down from highs exceeding $70 in mid-2021. The impacts of inflation, interest rate hikes, and changing consumer habits post-pandemic have contributed to this decline, alongside a shift towards streaming services affecting AMC’s traditional business model.

Furthermore, around September 2023, AMC announced its plans to reduce debt by raising capital through the issuance of new shares. While this announcement led to a significant drop in share prices, the company emphasized that this strategy aims to strengthen its balance sheet for future sustainability.

Factors Influencing AMC Stock

Several factors are driving the performance of AMC stock, including:

- Market Trends: The overall stock market trends and economic indicators play a significant role, including consumer spending levels and investor sentiment.

- Company Developments: AMC’s initiatives, such as partnering with new film studios and expanding its NFT marketplace, have garnered attention and could attract a new wave of investors.

- Retail Investor Influence: Retail investors on platforms like Reddit continue to have an influential role, turning AMC stock into a symbol of the fight against institutional short sellers.

Conclusion

Looking ahead, though the immediate outlook for AMC stock appears uncertain due to ongoing economic pressures and evolving consumer preferences, the engagement of retail investors creates a wild card. Analysts suggest that for AMC to stabilize, strategic corporate decisions focusing on debt reduction and innovation in content offerings are essential. Whether AMC can reclaim its standing in the market remains to be seen. Investors should remain vigilant and consider both the risks and potential opportunities offered by AMC stock, as the situation continues to evolve.