The Rise and Fall of Coinbase Stock: A Current Analysis

Introduction

Coinbase’s stock (NASDAQ: COIN) has been a focal point for investors and cryptocurrency enthusiasts alike. As one of the largest cryptocurrency exchanges in the world, Coinbase went public in April 2021, marking a significant milestone in the cryptocurrency sector. With the volatility of crypto markets and regulatory scrutiny, the performance of Coinbase stock is critical for those invested in digital assets and the tech sector.

Recent Performance and Market Trends

Since its debut on the stock market, Coinbase has experienced substantial fluctuations. In 2021, COIN shares soared to an all-time high of $429.54 in November, reflecting the excitement surrounding cryptocurrency markets. However, following the bear market in 2022 and increased regulatory pressures, the stock plummeted to around $30 by the beginning of 2023, causing concern among investors.

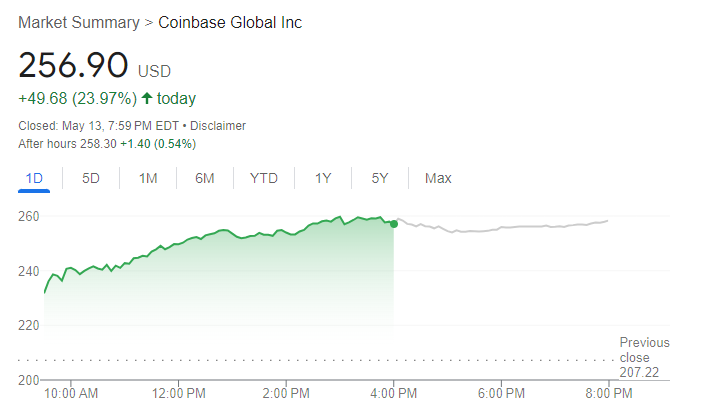

Recently, Coinbase stock has shown signs of recovery, trading around $90 by mid-October 2023. Analysts attribute this rebound to several factors: the gradual resurgence of cryptocurrency prices, increased user activity, and the company’s strategic shifts towards greater compliance with regulations. In its latest earnings report, Coinbase reported a profit exceeding market expectations, indicating a more resilient business model despite external pressures.

Regulatory Environment and Future Implications

The landscape for cryptocurrency trading and exchanges is rapidly evolving, with regulators around the world implementing new frameworks. In Canada, recent moves by the Canadian Securities Administrators (CSA) to increase oversight in crypto trading platforms reflect a broader trend aimed at protecting consumers and promoting fair trading practices.

Coinbase has proactively engaged with regulators, enhancing its compliance and reporting practices which could serve to stabilize its operations in the face of scrutiny. This approach may positively influence investor sentiment, as regulatory compliance is often viewed as a sign of a company’s commitment to longevity in a volatile market.

Conclusion and Outlook

The future of Coinbase stock remains uncertain, yet potential for growth is evident amid the recent recovery and the company’s strategic initiatives. Investors are encouraged to monitor developments both within the company and the broader regulatory environment that could impact the cryptocurrency market.

For anyone considering investment in Coinbase, understanding the dynamics of cryptocurrency trends, market regulation, and company performance metrics will be crucial for making informed decisions. As the crypto landscape evolves, Coinbase’s adaptability may determine its competitiveness and stock performance in the years to come.