UNH Stock: A Comprehensive Overview

Introduction

The stock of UnitedHealth Group Incorporated (UNH) holds significant importance in the healthcare sector and is a key player in the stock market. As a leading health services company, its performance can greatly influence market perceptions of the healthcare industry. Recent trends in UNH stock not only reflect the company’s financial health but also signal the economic outlook for healthcare services amidst ongoing changes in policy and consumer demand.

Current Market Trends

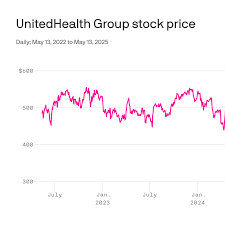

As of October 2023, UNH stock is trading at approximately $475 per share, continuing its upward trajectory with a notable increase of nearly 15% over the past year. This solid performance can be attributed to UnitedHealth’s robust earnings reports that consistently exceed analysts’ expectations. In the most recent quarter, the company reported a revenue growth of 9% year-on-year, driven primarily by its diversified offerings across insurance services and healthcare technology.

Market analysts have highlighted the strong demand for healthcare services, especially in the wake of the ongoing emphasis on public health and preventative measures. Furthermore, the aging population in North America, coupled with increased healthcare utilization, is predicted to sustain growth in UNH’s business segments. This trend is further reinforced by UnitedHealth’s strategic acquisitions, such as the purchasing of Change Healthcare in 2021, which bolsters their technological capabilities and streamlines service delivery.

Impact of Regulatory Changes

Another significant factor impacting UNH stock is the evolving regulatory landscape. Recent legislative developments aim to lower prescription drug prices and expand access to healthcare, which could initially pressure profit margins. However, industry analysts remain positive, suggesting that UnitedHealth’s extensive market reach and innovative solutions will enable it to adapt and thrive under such changes.

Conclusion

As UNH stock continues to demonstrate resilience amidst market fluctuations and regulatory shifts, it remains a focal point for both investors and analysts. The outlook for UnitedHealth Group appears promising, with experts forecasting continued growth fueled by technological advancements and a growing market for health services. For investors, UNH stock not only represents a stable investment in the healthcare sector but also serves as a bellwether for overall market trends within the industry. As we move into 2024, monitoring UNH’s performance will provide valuable insights into the future of healthcare investment opportunities.