A Comprehensive Look at AAPL Stock Performance

Introduction

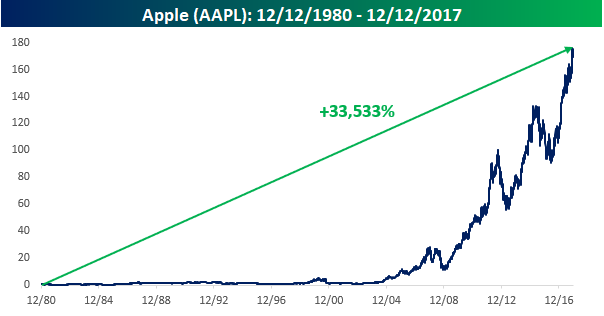

AAPL stock, representing Apple Inc., has long been a focal point for investors and market analysts alike. As one of the largest companies in the world by market capitalization, Apple’s performance directly influences broader stock market trends. Recently, AAPL stock has shown significant movement, raising important questions about its future trajectory amid changing economic conditions.

Recent Performance and Analysis

As of mid-October 2023, AAPL stock is trading at approximately $177 per share, reflecting a 15% increase over the past year. This growth can be attributed to a series of successful product launches, including the latest iPhone models and advancements in Apple’s services sector, including Apple Music and Apple TV+. Moreover, Apple’s expansion into new market segments like augmented reality and electric vehicles has piqued investor interest.

Recent quarterly earnings reports showcased Apple’s ability to adapt and thrive despite macroeconomic challenges. In Q2 2023, the company posted revenue of $94 billion, exceeding analyst expectations and reaffirming Apple’s status as a leader in the tech sector. This performance was primarily driven by robust sales in the iPhone category, which continues to dominate the market, alongside growth in services that yield higher profit margins.

Market Factors Influencing AAPL Stock

Several factors are currently influencing AAPL stock’s movement. The global supply chain issues that affected many technology companies have persisted but are gradually improving. Analysts note that Apple’s investment in diversifying its supply chain has provided resilience against shortages faced by competitors.

On the macroeconomic front, interest rate fluctuations and inflation worries have also had a notable impact on tech stocks, including AAPL. Investors are currently weighing the potential effects of economic policy changes from the Federal Reserve, which could influence consumer spending and, consequently, the demand for Apple’s products.

Conclusion and Forward Outlook

Considering the current landscape, experts believe AAPL stock remains a strong investment option. However, they advise investors to remain cautious of potential volatility in the technology sector. As Apple continues to innovate and diversify its revenue streams, many analysts predict steady growth in stock value over the upcoming quarters. For investors, understanding the intricacies of the tech market and the factors influencing AAPL stock will be crucial to making informed decisions.