Understanding Interest Rates in Canada: Trends and Future Outlook

The Importance of Interest Rates in Canada’s Economy

Interest rates play a crucial role in shaping the economic landscape of Canada. They influence borrowing costs, spending habits, and overall economic growth. As the Bank of Canada (BoC) continues to adjust interest rates in response to inflation and economic conditions, it has significant implications for consumers, businesses, and investors alike.

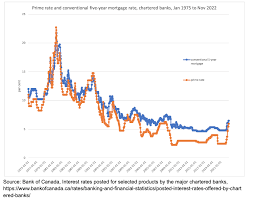

Current Interest Rate Trends

As of October 2023, the Bank of Canada has maintained its benchmark interest rate at 5.00%, following a series of increases earlier in the year aimed at curbing inflation. Despite a temporary easing of inflationary pressures, the central bank remains cautious, acknowledging persistent challenges such as supply chain issues and rising global energy costs. The recently released Consumer Price Index (CPI) data shows inflation at 3.8%, still above the BoC’s target of 2%. This context leads to speculation about future interest rate adjustments.

Impact on Consumers and Businesses

High interest rates have a notable effect on mortgage rates, car loans, and credit card interest rates. Homebuyers are particularly feeling the pinch, as elevated mortgage rates can reduce affordability and dampen housing market activity. Similarly, businesses are facing higher costs of borrowing, which may restrain expansion plans. According to a recent survey by the Canadian Federation of Independent Business, 34% of small business owners reported that rising interest rates hinder their ability to invest in growth.

Future Predictions and Insights

Economists are predicting that interest rates may remain at current levels for the foreseeable future. Many analysts believe that inflation will continue to moderate, potentially allowing the BoC to reconsider its stance in early 2024. However, uncertainties surrounding global economic conditions and domestic growth will play a crucial role in shaping these decisions. As noted by a leading economic analyst, “The BoC is in a balancing act where it must closely monitor both inflation trends and economic growth to guide its next steps.”

Conclusion: What It Means for Canadians

The trajectory of interest rates in Canada is pivotal for the economy’s health. For consumers, understanding these trends is essential for making informed financial decisions regarding loans and investments. For businesses, it may influence hiring and capital expenditures. As the situation evolves, keeping an eye on inflation and economic performance will be crucial for all Canadians navigating these challenging financial waters.