Updates on the Bank of Canada Interest Rate

The Importance of Interest Rates in Canada

The Bank of Canada (BoC) plays a crucial role in shaping the Canadian economy, particularly through its control of interest rates. Interest rates not only influence borrowing costs and consumer spending but also affect inflation and overall economic growth. As the BoC adjusts its key policy rate in response to economic conditions, these changes ripple through the financial system, impacting households, businesses, and the broader economy.

Recent Developments

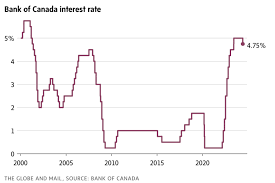

As of October 2023, the Bank of Canada has maintained its target for the overnight interest rate at 5.00%, marking a steady position in light of ongoing economic challenges. This decision follows a series of rate hikes earlier in the year aimed at curbing inflation, which has been a significant concern amid global economic uncertainties. The BoC’s current stance reflects an attempt to balance between slowing inflation and ensuring economic growth does not stall.

The inflation rate in Canada has shown signs of easing, with the most recent figures indicating it has dropped to 4.0% from previous highs. While this is a positive trend, the BoC remains vigilant, citing risks such as strong consumer demand and persistent supply chain issues that could reignite inflationary pressures.

The Economic Implications

With the current interest rate set at 5.00%, Canadians can expect higher borrowing costs, impacting mortgages, personal loans, and credit card rates. For homeowners, this translates into increased monthly payments, while prospective buyers may be hesitant due to higher mortgage costs. On the other hand, higher interest rates can benefit savers, as they receive better returns on deposit accounts.

Economists project that if inflation continues to moderate, the BoC may consider holding rates steady in the upcoming months, allowing the economy to adjust without the added pressure of increasing borrowing costs. Conversely, any signs of rising inflation could prompt further rate hikes.

Conclusion: Looking Ahead

In conclusion, the Bank of Canada’s interest rate decisions are pivotal for the nation’s financial landscape. As we look toward the future, it is essential for Canadians to stay informed about economic indicators and the BoC’s policy meetings to navigate their financial decisions effectively. The balance between managing inflation and fostering economic growth will remain a defining challenge for the Bank, with implications that will affect all Canadians in the coming months.