Understanding the Bond Market: Current Trends and Importance

Introduction

The bond market plays a critical role in the financial system, providing a platform for governments and corporations to raise capital. It offers investors a means of earning interest over time while contributing to the overall economic stability. In Canada, the bond market has seen notable shifts recently, prompting discussions among investors, policymakers, and financial analysts.

Current Trends in the Canadian Bond Market

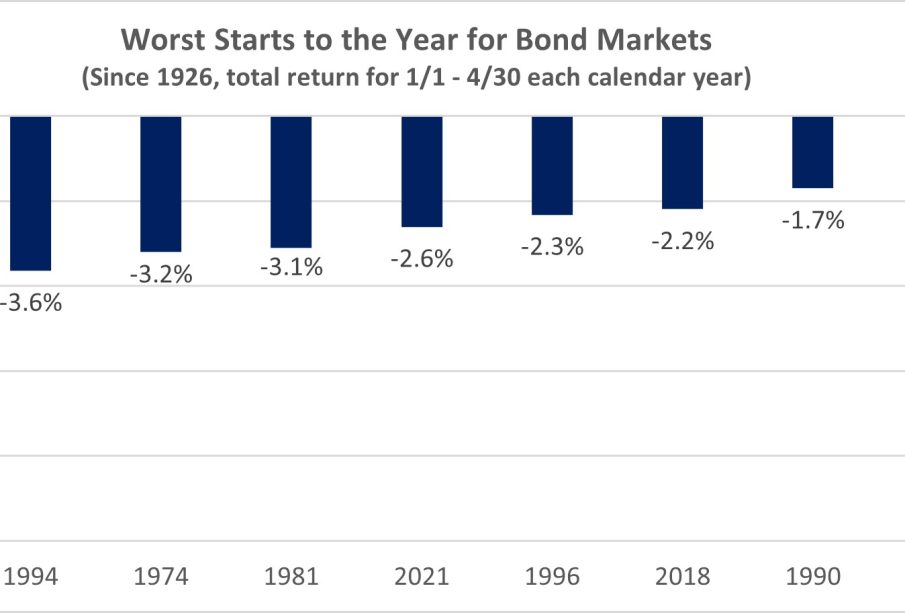

As of late 2023, the Canadian bond market is experiencing fluctuations driven by several factors including economic growth, inflation rates, and central bank policies. Recent data indicates that Canadian government bonds have yielded lower returns compared to corporate bonds, compelling investors to reassess their portfolios.

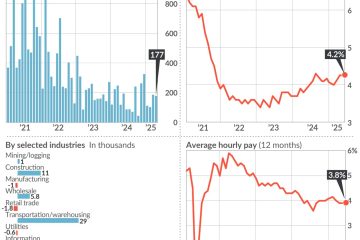

The Bank of Canada’s approach to interest rates continues to influence the bond market. As inflation stabilizes, forecasts suggest that the Bank may maintain interest rates, leading to increased demand for both government and corporate bonds as safer investment avenues. This situation arises in light of recent economic indicators showing moderated inflation and stable job growth.

Investment Strategies and Opportunities

Investors are currently navigating through this landscape by diversifying their bond holdings. Emerging sectors, particularly green bonds aimed at financing environmentally sustainable projects, are gaining traction. This aligns with Canada’s commitment to achieving net-zero carbon emissions by 2050, thereby introducing new opportunities within the bond market.

Furthermore, high-yield corporate bonds are drawing attention as companies recover from pandemic-induced challenges. Investment sentiment remains cautiously optimistic, highlighted by the rise in issuance from Canadian corporations aiming to capitalize on favorable market conditions.

Conclusion

The bond market remains a fundamental component of investment strategies in Canada, particularly in a shifting economic environment. As we look ahead, market analysts predict that the stability of the bond market will depend largely on the Bank of Canada’s monetary policy and global economic conditions. For investors, understanding these dynamics will be crucial in making informed decisions. Monitoring the bond market trends can provide insights into the prevailing economic landscape and offer potential paths for financial growth.