What Is a Dead Cat Bounce and Why Does It Matter?

Introduction

In the world of financial trading and investment, understanding market trends is crucial for making informed decisions. One term that often arises in discussions about market behavior is ‘dead cat bounce.’ This concept is particularly relevant amid the volatility seen in today’s stock markets, driven by economic fluctuations and geopolitical tensions.

The Nature of a Dead Cat Bounce

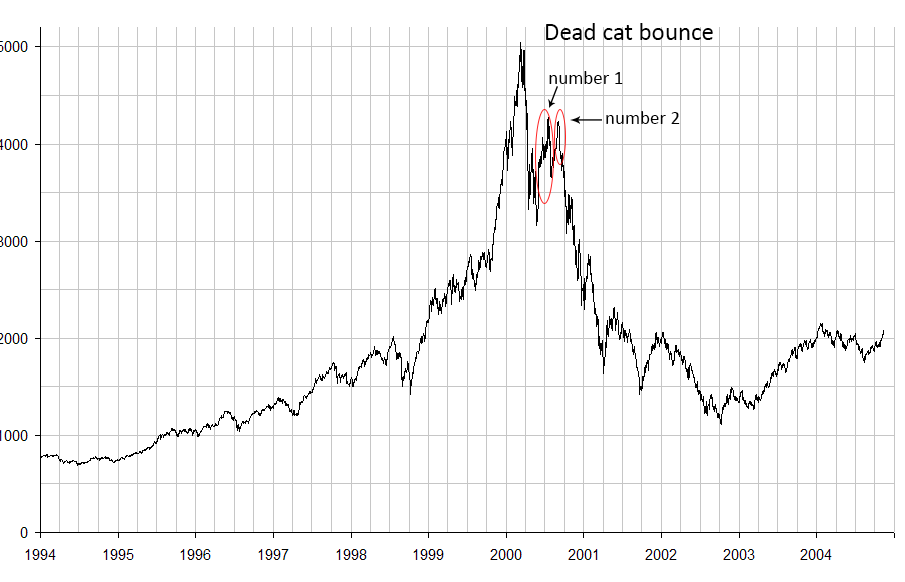

A ‘dead cat bounce’ refers to a temporary recovery in the price of a declining stock or market, followed by a continuation of the downward trend. The term suggests that even a dead cat will bounce if it falls from a great height. In practical terms, this phenomenon occurs when traders jump back into a declining asset due to a momentary positive sentiment, often fueled by short-term news or optimism, only to find that the underlying issues that caused the decline remain unresolved.

Recent Context

As of late 2023, financial markets have experienced significant fluctuations with heightened investor uncertainty. Following a notable drop in tech stocks due to rising interest rates and inflation concerns, analysts have observed instances of dead cat bounces. For example, following a dip in the stocks of major tech companies in September, there was a brief rebound, leading some investors to believe that a recovery was underway. However, subsequent events indicated that the long-term bearish trend still affected these stocks, illustrating the dead cat bounce phenomenon.

Investment professionals closely monitor these rebounds as they can signal potential traps for unsuspecting investors, particularly those driven by emotion rather than sound analysis. A comprehensive understanding of dead cat bounces can improve trading strategies, enabling investors to differentiate between a genuine market recovery and a mere blip in a larger downward trend.

Conclusion

While dead cat bounces might offer short-term trading opportunities, they also serve as a cautionary tale for investors. Recognizing the signs of a potential bounce amid a bad streak is crucial to avoid losses due to an ill-timed decision. As markets continue to evolve, staying informed and being able to identify these price patterns could be key to navigating future investments successfully. Understanding such concepts is essential for both novice and experienced investors to make informed decisions in the ever-changing landscape of stock trading.