Analyzing Berkshire Hathaway Stock: Trends and Insights

Introduction

Berkshire Hathaway Inc., one of the largest conglomerates in the world led by CEO Warren Buffett, has continued to capture the attention of investors and analysts alike. As the company engages in various sectors including insurance, energy, and consumer goods, understanding its stock performance is crucial for potential investors. Recently, the fluctuations in Berkshire Hathaway stock have raised questions regarding its future, given the macroeconomic conditions and market trends.

Current Performance of Berkshire Hathaway Stock

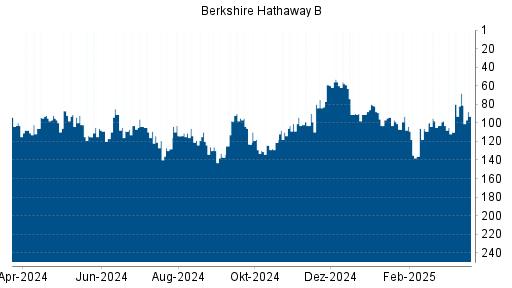

As of late October 2023, Berkshire Hathaway’s Class A shares are trading around $700,000, while Class B shares hover near $450. The stock has seen a steady growth trajectory, with an increase of approximately 14% year-to-date, reflecting positive investor sentiment despite the overall market volatility caused by inflation and rising interest rates.

The company’s diversification across industries is a strength that has proven resilient during economic downturns. Notably, Berkshire’s holdings in companies like Apple, Bank of America, and Coca-Cola contribute significantly to its performance. The strong earnings report for Q3 2023, which highlighted revenue growth across several sectors, has also buoyed investor confidence.

Market Sentiment and Economic Factors

Analysts are keeping a close eye on several economic factors that could influence Berkshire Hathaway stock in the coming months. With ongoing discussions about monetary policy adjustments by the Federal Reserve, interest rates will play a crucial role in investment decisions. Additionally, supply chain disruptions and inflation remain pressing issues that could impact Berkshire’s subsidiaries and, consequently, its stock performance.

Future Outlook

Looking ahead, experts predict that Berkshire Hathaway stock will continue to benefit from Warren Buffett’s investment strategies and the company’s robust portfolio. The continued emphasis on value investment and long-term growth will likely maintain stable returns for investors.

However, potential investors should remain cautious. While the stock has shown consistent growth, market corrections and economic uncertainty could present risks. Conducting thorough research and considering diversifying investment portfolios will help mitigate these risks.

Conclusion

In summary, Berkshire Hathaway stock offers a compelling investment opportunity for those willing to navigate market challenges. As it continues to adapt to changing economic landscapes, staying informed about its performance and associated risks will be vital for investors seeking to maximize their portfolios.