Current Trends and Insights on BCE Stock

Introduction

BCE Inc., one of Canada’s largest telecommunications companies, continues to be a focal point in the stock market due to its vital role in connectivity and media services. The performance of BCE stock (TSX: BCE) is significant not only for investors but also for the broader Canadian economy, especially as the demand for telecommunication services grows. In this article, we will delve into the current state of BCE stock, recent developments, and future outlooks that could impact potential investors.

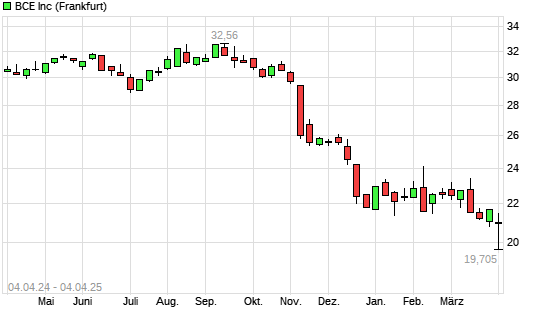

Current Stock Performance

As of mid-October 2023, BCE stock has shown a mixed performance amidst a fluctuating market. Trading around CAD 64.50, BCE stock remains steady compared to previous months but reflects a decrease compared to its peak earlier this year. Analysts attribute this stability to BCE’s robust business model, focusing on solid dividends and essential services.

Recent Developments

Recent announcements from BCE indicate continued investment in infrastructure and technology advancements. On October 1, 2023, BCE reported plans to invest CAD 1.3 billion in expanding its 5G networks across Canada. This initiative aims to enhance service quality and meet increasing consumer demand for faster internet speeds.

Moreover, BCE has also made headlines by partnering with various content creators to bolster its streaming services, positioning itself against competitors such as Rogers and Shaw. These moves are essential not only for revenue growth but also for maintaining market share in a rapidly evolving digital landscape.

Analyst Insights

Market analysts view BCE as a solid long-term investment, especially for those seeking steady income through dividends. The stock currently offers an attractive yield of approximately 5.5%, appealing to income-focused investors. Additionally, various studies suggest that with the exponential growth of data consumption and digital connectivity, BCE is well-positioned to capitalize on these trends.

Conclusion

In conclusion, while BCE stock has experienced some fluctuations, its underlying business fundamentals remain strong. The company’s forward-thinking investments in technology and infrastructure make it a valuable option for investors looking for stability and growth in the telecommunications sector. As the demand for mobile and broadband services continues to escalate, BCE could see its stock performance improve significantly in the coming months. Potential investors should closely monitor BCE’s strategic moves and market conditions to make well-informed decisions.