Understanding the S & P 500: Trends and Market Insights

Introduction to the S & P 500

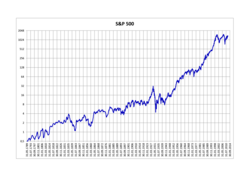

The S & P 500, short for Standard & Poor’s 500, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is widely regarded as one of the best representations of the U.S. stock market and a key indicator of the overall economy. Investors closely monitor this index to gauge the health of equity markets and to inform investment strategies.

Recent Performance and Key Trends

As of October 2023, the S & P 500 has experienced notable volatility, reflecting broader economic uncertainties. After a strong performance in 2021 and early 2022, characterized by a post-pandemic surge, the index has faced challenges including inflation concerns, rising interest rates, and geopolitical tensions.

Recent data shows that the S & P 500 has navigated significant ups and downs, with a year-to-date performance fluctuating between gains and losses. As of mid-October, the index had rebounded from earlier lows, largely driven by strong corporate earnings reports and a less aggressive stance from the Federal Reserve regarding interest rate hikes. Notably, technology stocks have led this resurgence, with companies like Apple, Microsoft, and Amazon posting strong quarterly results.

Economic Factors Influencing the S & P 500

Several economic factors continue to influence the S & P 500’s trajectory. Inflation remains a critical concern, with consumer prices rising at a rate that has led to increased costs of living. This has caused investors to remain cautious as inflation can erode purchasing power and affect corporate profits.

Moreover, labor market dynamics and supply chain disruptions are also proving to be significant factors. While the job market shows resilience, varying levels of employment across sectors may impact consumer spending, which accounts for a substantial part of the U.S. economy.

Conclusion and Future Outlook

Looking ahead, analysts maintain a cautious but optimistic outlook for the S & P 500. The consensus view is that while volatility may persist in the short-term due to macroeconomic factors and external uncertainties, the medium to long-term trajectory remains positive, supported by ongoing corporate innovation and economic recovery efforts.

Investors are advised to stay informed and adapt their strategies in alignment with market trends and economic indicators. Understanding the movements of the S & P 500 not only helps in making informed investment decisions but also serves as a barometer for the overall economic climate.