Understanding the Hang Seng Index: Insights and Trends

Introduction to the Hang Seng Index

The Hang Seng Index (HSI) is a crucial barometer of the Hong Kong stock market, encompassing the largest and most liquid companies listed on the Hong Kong Stock Exchange. It holds significant relevance not only for investors in Hong Kong but also for global investors seeking insights into the dynamics of the Asian market.

Current Trends and Market Dynamics

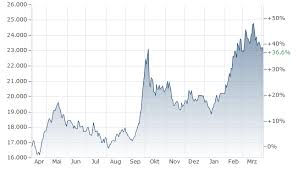

As of October 2023, the Hang Seng Index has experienced notable fluctuations influenced by various factors, including economic policies, external trade dynamics, and shifts in investor sentiment. Recently, the index has seen a recovery trend following a dip earlier in the year due to concerns over global inflation and rising interest rates.

Key components driving the HSI include major sectors such as finance, technology, and real estate. The recent resurgence of tech stocks, particularly those in the e-commerce and digital payments space, has contributed to a boost in the index, highlighting a shift toward a more tech-oriented market in Hong Kong.

Recent Developments Impacting the Index

Amidst ongoing geopolitical tensions, particularly with the U.S. and within the Asia-Pacific region, the HSI’s performance remains sensitive to news regarding international trade agreements and local political developments. The Hong Kong government’s ongoing strategies to invigorate the economy post-pandemic, including tax incentives and financial reforms, have also played a role in shaping investor confidence.

Conclusion: Importance of Monitoring the Hang Seng Index

For investors, analysts, and economic strategists, keeping an eye on the Hang Seng Index is imperative for understanding the broader economic landscape of Hong Kong and its impact on global markets. As more multinational firms continue to invest in this region, fluctuations in the HSI will offer insights into economic trends, sector performances, and investor behaviors. Looking ahead, forecasts suggest that the index may continue to stabilize, barring any major economic shocks or policy changes, underpinning its significance as a leading economic indicator in Asia.