A Comprehensive Overview of AAPL Stock Performance

Introduction

AAPL stock, the ticker symbol for Apple Inc., is a focal point for investors and analysts alike, representing one of the largest and most influential companies in the world. With significant influence over technology and consumer electronics sectors, understanding AAPL’s stock performance is crucial for anyone interested in the stock market and investment strategies. As of October 2023, AAPL stock continues to evolve, reflecting broader market trends, consumer demand, and technological advancements.

Current Performance and Market Trends

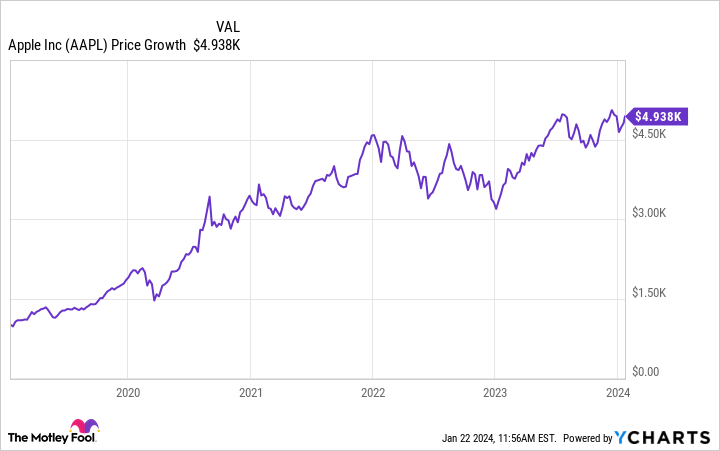

As of the latest trading sessions, AAPL stock has shown resilience with a modest increase of approximately 4% over the last month. Recent analyst reports suggest that Apple’s upcoming product launches, including anticipated updates to the iPhone and new services in its ecosystem, could positively influence stock performance.

Market analysts are closely watching Apple’s quarterly earnings report to be released at the end of October. Predictions indicate a potential earnings surge, attributed to strong sales in both hardware and software segments. Analysts from Goldman Sachs have rated AAPL stock as a “Buy,” reinforcing the notion that innovation and marketing strategies will keep driving company growth and shareholder value.

Investor Sentiment and Broader Impact

Investor sentiment around AAPL stock is largely optimistic, especially with the company’s demonstrated ability to adapt to market challenges. Several hedge funds and institutional investors have increased their stakes in Apple, considering it a vital component of a diversified portfolio. Furthermore, as the tech industry faces increasing scrutiny regarding privacy and antitrust issues, Apple’s proactive policies and commitment to consumer privacy have bolstered investor confidence.

Additionally, Apple’s exposure to international markets presents both risks and opportunities. Recent geopolitical tensions and supply chain challenges have prompted discussions about potential impacts on Apple’s manufacturing and profitability. However, Apple’s strategic partnerships and diverse supplier network are seen as mitigating factors.

Conclusion

In conclusion, AAPL stock remains a significant subject for investors navigating through an ever-changing market landscape. With a positive outlook supported by a strong product pipeline and solid fundamentals, Apple is poised to maintain its position as a market leader. Investors should stay informed about the upcoming earnings report and market conditions, keeping an eye on how these factors may influence stock trajectory. For those considering investment, AAPL stock represents both opportunity and insight into the future of technology and consumer habits.