RBC Stock: Recent Trends and Market Performance

Introduction

The Royal Bank of Canada (RBC) is one of the largest financial institutions in the country, playing a critical role in Canada’s banking sector. Recently, RBC stock has been in the spotlight, particularly due to fluctuating market conditions and macroeconomic factors impacting investor sentiment. Understanding these trends is essential for investors and those tracking the financial markets.

Recent Market Trends

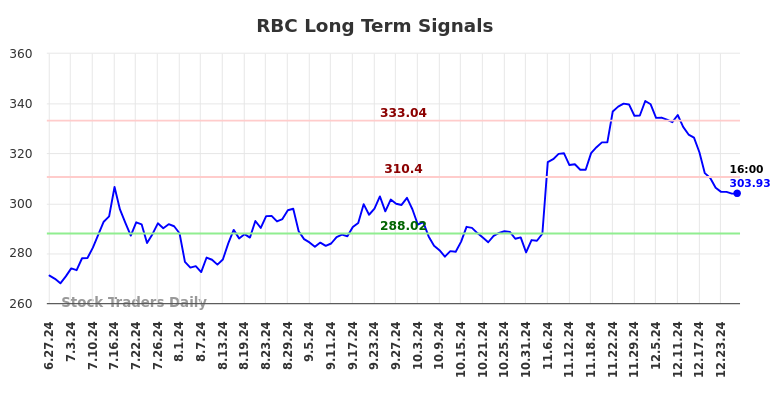

As of October 20, 2023, RBC’s stock price has seen significant volatility, with shares trading around $130 CAD, reflecting a decrease of approximately 5% over the past month. Analysts attribute this decline to several factors, including rising interest rates set by the Bank of Canada aimed at curbing inflation and growing concerns regarding a potential economic slowdown.

Recent reports indicate that the Canadian economy is showing signs of strain, with sectors such as housing experiencing downturns. This has weighed on financial stocks, including RBC, which is heavily involved in mortgage lending and personal loans. Additionally, global economic uncertainties, including geopolitical tensions and fluctuating oil prices, have prompted investors to adopt a cautious stance.

Investor Sentiment and Future Outlook

Despite these challenges, RBC maintains a strong market presence with a solid financial foundation, evidenced by their recent earnings report showing resilient profits bolstered by their wealth management services. Analysts continue to express optimism about RBC’s long-term prospects, given its diversified revenue streams and scale of operations. As a result, RBC is still considered a key player and a strong potential investment for long-term holders.

Investment experts suggest that fluctuations could provide a buying opportunity for investors looking to enter the market at a lower price point. Furthermore, RBC has a history of returning value to its shareholders through dividends, maintaining an attractive yield which can offset some market volatility risks.

Conclusion

In summary, RBC stock has faced challenges recently amid broader economic shifts, reflecting the current climate of uncertainty in the market. However, its historical strength and diversified operations provide a stable outlook for potential investors. As market conditions evolve, it remains essential for stakeholders to stay informed about developments and consider the implications for their investment strategies.