Enbridge Stock: Performance Insights and Market Impact

Introduction

Enbridge Inc., a leading North American energy infrastructure company, has seen significant fluctuations in its stock performance over the past few months. As investors navigate current energy market dynamics, understanding Enbridge’s stock movements and their implications becomes crucial. The company, known for its extensive network of pipelines and renewable energy initiatives, is particularly relevant today as global energy transitions gather pace.

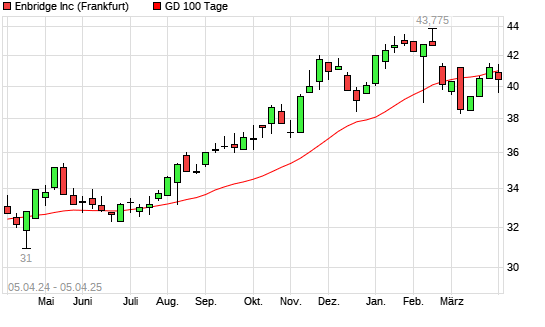

Current Stock Performance

As of mid-October 2023, Enbridge stock (NYSE: ENB) has experienced a notable rally, reflecting a broader recovery in the energy sector. After facing pressure earlier in the year due to rising interest rates and fluctuating oil prices, the stock has rebounded to approximately CAD 53 per share. Analysts attribute this recovery to several factors, including robust energy demand, strategic infrastructure investments, and stronger-than-expected quarterly earnings.

Factors Driving Stock Changes

Several key factors influence Enbridge’s stock performance:

- Infrastructure Developments: Enbridge’s ongoing investments in pipeline infrastructure and renewable energy projects bolster investor confidence, ensuring future revenue streams.

- Regulatory Environment: Changes in regulations, particularly those related to environmental concerns, can pose both risks and opportunities for Enbridge, affecting investor sentiment.

- Market Trends: The rise in oil and gas prices, driven by geopolitical tensions and supply constraints, has played a crucial role in enhancing the company’s revenue outlook.

Looking Ahead

Analysts remain cautiously optimistic about Enbridge’s future, projecting steady growth driven by ongoing energy demands and the company’s pivot towards renewable sources. Predictions suggest that the stock could reach CAD 60-65 in the next year if current trends hold, contingent on stable commodity prices and successful project rollouts. However, potential risks such as regulatory changes and market volatility remain pertinent concerns for investors.

Conclusion

Enbridge stock continues to be a focal point for investors, reflecting broader trends in the energy market. As the company positions itself strategically in evolving sectors, its stock performance will likely remain intertwined with global energy dynamics, regulatory landscapes, and infrastructure developments. For investors seeking to understand the current and future profitability of energy stocks, keeping an eye on Enbridge will be essential.