Understanding the Impact of the S&P 500 in Today’s Market

Importance of the S&P 500

The S&P 500 Index, a crucial benchmark for the U.S. stock market, comprises 500 of the largest publicly traded companies in the United States. It serves as a barometer for the overall health of the U.S. economy and is closely monitored by investors globally. Understanding the dynamics of the S&P 500 is vital not only for seasoned investors but also for those just beginning their investment journey.

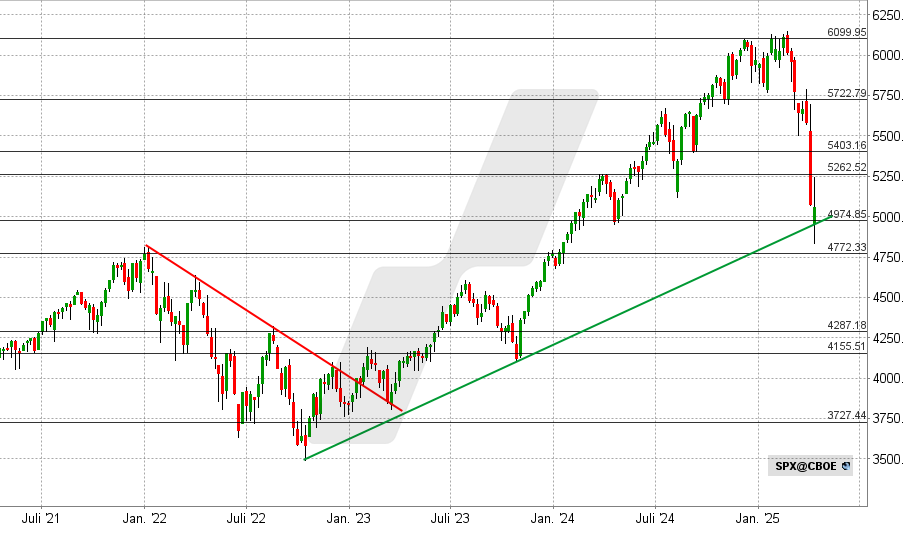

Recent Trends and Performance

As of October 2023, the S&P 500 has shown resilience despite ongoing global economic challenges, including inflation and geopolitical tensions. Year-to-date, the index has increased approximately 15%, benefiting from a tech-driven rally, particularly in sectors like artificial intelligence and renewable energy. Companies such as Microsoft, Apple, and Nvidia have significantly influenced the broader index due to their large market capitalizations.

According to recent reports from S&P Dow Jones Indices, the sectors contributing most positively to the index include Information Technology, Consumer Discretionary, and Health Care. The recent tightening of monetary policy by the Federal Reserve in response to persistent inflation has created a mixed environment for stocks, whereby investors are proceeding with caution. Volatility has been a persistent theme, necessitating agile strategies from investors to navigate short-term fluctuations.

Looking Ahead: What Does the Future Hold?

Analysts indicate that the S&P 500 could continue to face pressure from global economic uncertainties and interest rate hikes in the coming months. However, optimism persists regarding corporate earnings growth, particularly within tech companies driven by innovation. Many speculate that the index may rebound once inflationary pressures begin to ease, and the Federal Reserve communicates a clear path regarding interest rates.

It is essential for investors to remain informed and adaptable to the evolving market landscape. Diversification and understanding the assets constituting the S&P 500 could lead to informed investment decisions that align with personal financial goals.

Conclusion

The S&P 500 remains a pivotal element of the U.S. economy and global markets. Its performance not only reflects the current economic climate but also impacts investment strategies and financial planning for individuals and institutions. Staying abreast of market trends and economic indicators related to the S&P 500 will empower investors to make more informed decisions as they navigate the complexities of today’s financial markets.