Understanding Black Monday: Impact and Significance

Introduction

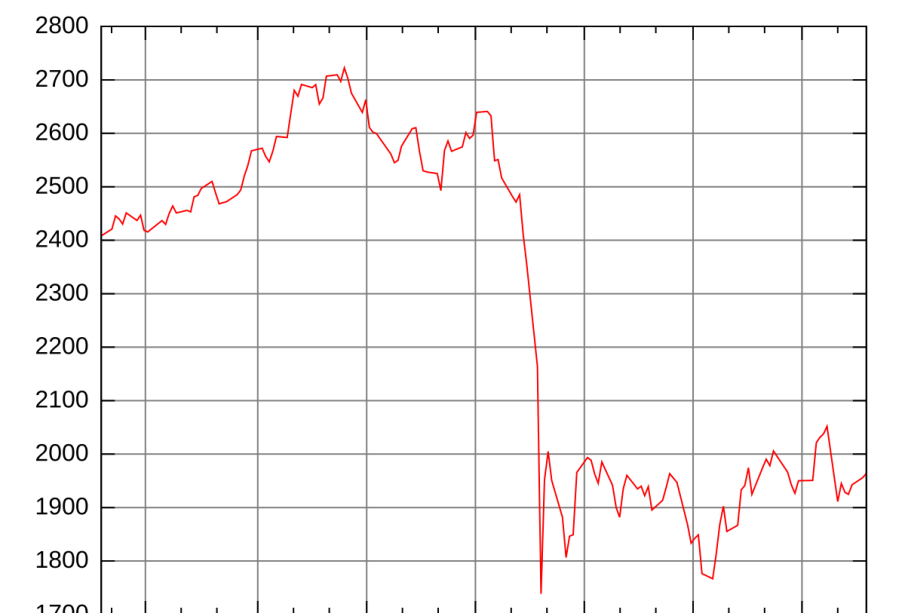

Black Monday refers to several significant stock market crashes throughout history, primarily associated with events that triggered widespread economic concern. Understanding Black Monday and its implications is crucial as it offers insight into market volatility, investor behavior, and the potential for global economic repercussions. The most notable Black Monday occurred on October 19, 1987, when the Dow Jones Industrial Average fell dramatically by over 22% in a single day, marking one of the most significant market declines in history.

The Events of 1987’s Black Monday

The origins of Black Monday are linked to a combination of factors that contributed to one of the most notorious stock market crashes. In the weeks leading up to October 19, 1987, stock prices had risen continuously, raising concerns about overvaluation. Investor anxiety about rising interest rates, a growing trade deficit, and escalating geopolitical tensions compounded these fears. On that fateful day, an avalanche of selling triggered a cascading effect where automated trading systems exacerbated the decline. Major stock indexes plummeted globally, putting many investors and institutions at risk of huge losses.

Comparative Analysis with Other Market Crashes

While 1987’s Black Monday remains the most referenced, other events have further defined the term ‘Black Monday.’ For instance, the market crash of September 29, 2008, during the financial crisis saw a significant drop in stock prices, leading to widespread panic. Similarly, Black Monday references have also been used for other critical downturns, such as March 16, 2020, when the stock market fell drastically due to the uncertainty surrounding the COVID-19 pandemic. Each of these instances highlights the interconnected nature of global markets and the impact of uncertainties on investor sentiment.

Current Implications and Conclusion

The lessons drawn from Black Monday and other similar events are essential for investors and policymakers alike. Economic indicators, investor sentiment, and regulatory responses continue to play vital roles in financial stability. Forecasts suggest that as markets evolve, the potential for future crashes will persist, especially in an increasingly complex global financial environment. By studying past Black Mondays, investors can equip themselves with knowledge that may help mitigate risks associated with future market downturns. Ultimately, Black Monday serves as a reminder of the volatility inherent in financial markets and the importance of prudent investment strategies.