Understanding the Recent Market Crash: Causes and Effects

Introduction

The recent market crash has sent shockwaves through financial markets worldwide, raising concerns among investors and financial analysts alike. Understanding the causes and implications of this market turbulence is crucial as it impacts not only traders but also the overall economy. With the ongoing global economic challenges, the relevance of studying market crashes has never been greater.

Details of the Recent Market Crash

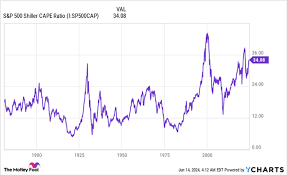

In the last few weeks, major indices have seen significant downturns, with the S&P 500 falling by over 10% from its peak in mid-August 2023. Analysts attribute this drop to a mix of factors, including rising interest rates initiated by central banks in an effort to curb inflation, geopolitical tensions, and supply chain disruptions exacerbated by recent global events.

A notable trigger for the crash was the announcement from the U.S. Federal Reserve regarding potential further interest rate hikes in response to persistent inflationary pressures. This decision, seen as necessary for economic stability, is contributing to increased borrowing costs and greater uncertainty among investors. The Bank of Canada is also mirroring these trends, maintaining tighter monetary policy in a bid to control inflation within its borders.

Economic Indicators and the Broader Impact

Several economic indicators have begun to reflect the ongoing market instability. Recent data on consumer confidence has shown a decline, with many Canadians expressing worry over their financial futures. Employment rates, which had previously shown signs of recovery, are beginning to stagnate as businesses react to the uncertain market conditions.

The real estate sector is also feeling the pinch as mortgage rates rise, leading to reduced home affordability and slowing down the housing market. Additionally, sectors such as technology and retail, which had thrived during the pandemic, have seen significant reversals in stock value.

Conclusion: Navigating the Aftermath

As the dust settles from the recent market crash, experts suggest a cautious approach for investors. While it may be tempting to react impulsively during times of volatility, analysts advise focusing on long-term investment strategies and diversifying portfolios to mitigate risk.

The long-term significance of this market event will depend on various recovery factors, including governmental policy adjustments and consumer confidence rebounding. Investors should remain informed and attentive to changes in market conditions, as the potential for recovery often follows such downturns. Now is the time for both seasoned and new investors to evaluate their financial strategies in light of recent events, ensuring they are prepared for both the challenges and opportunities that may lie ahead.