Understanding SQQQ Stock: Current Trends and Future Outlook

Introduction

SQQQ stock, officially known as ProShares UltraPro Short QQQ, has gained significant attention among investors looking to profit from declines in the Nasdaq-100 index. As economic uncertainties continue to loom large, understanding the dynamics of SQQQ becomes crucial for retail and institutional investors alike. On October 2023, discussions surrounding inflation, interest rates, and geopolitical tensions have kept volatility at the forefront, making SQQQ a popular instrument for hedging and speculative plays.

Current Market Landscape

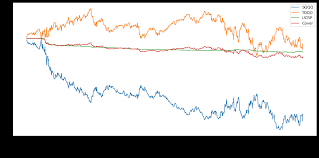

As of mid-October 2023, the Nasdaq-100 index has shown a mixed performance in response to the fluctuating economic indicators. The recent earnings reports from major tech firms have further influenced investor sentiment, leading to increased interest in inverse ETFs like SQQQ. The fund seeks to deliver three times the inverse daily performance of the index, making it a leveraged option for those anticipating a downturn.

In 2023, the SQQQ stock has experienced notable volatility, largely in response to Federal Reserve policy updates and macroeconomic data. The ongoing battle against inflation, alongside interest rate hikes, has placed significant pressure on technology stocks, which dominate the Nasdaq-100. As investors brace for potential market corrections, SQQQ’s volume has surged, reflecting heightened interest in short-selling opportunities.

Performance Metrics

Recent performance data illustrates the heightened activity among investors trading SQQQ stock. In October alone, reports indicated that trading volumes were significantly above the average, suggesting that a considerable number of investors are engaging in short positions on the Nasdaq-100. Analysts have noted that the stock is particularly appealing for day traders and those reacting to rapid market shifts.

Conclusion and Future Outlook

In summary, SQQQ stock remains a critical tool for investors aiming to capitalize on bearish market trends within the technology sector. As global economic conditions evolve, with further Federal Reserve decisions anticipated later this year, the future of SQQQ will largely depend on how these decisions impact market sentiment. Investors should approach this leveraged instrument with caution, keeping a keen eye on risk management strategies. The potential for significant returns exists, but it is matched by the risk of steep losses, making it essential to assess each individual investment’s alignment with broader portfolio objectives.