Current Trends and Insights into META Stock Price

Introduction

The META stock price, belonging to Meta Platforms, Inc., the parent company of Facebook, Instagram, and WhatsApp, has been a focal point for investors and market analysts alike. With increasing scrutiny on social media platforms and evolving trends in the tech industry, understanding the dynamics of META’s stock price is crucial for both seasoned investors and new entrants in the market.

Current Market Performance

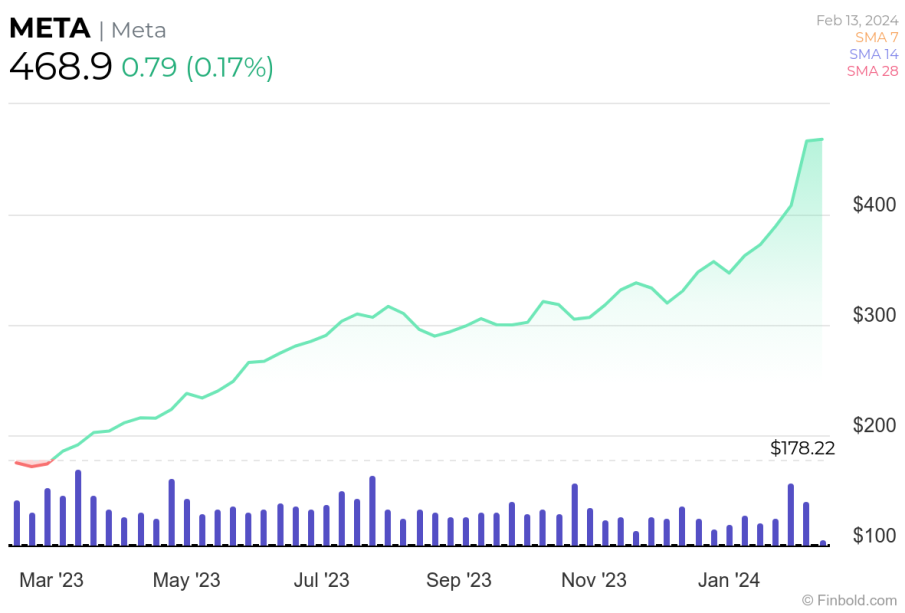

As of October 2023, META’s stock has seen notable fluctuations. Currently, the stock is trading at approximately $300, reflecting an increase of about 15% over the past month. This uptick can be attributed to several key factors, including a strong quarterly earnings report and growing optimism regarding the company’s investments in augmented and virtual realities. In the latest earnings call, Meta reported revenue exceeding analysts’ expectations, which significantly boosted market confidence in its future growth potential.

Factors Influencing META Stock Price

The stock price of META is influenced by a combination of market trends and company-specific news. The tech sector as a whole has been recovering from the declines observed in 2022, and Meta has positioned itself as a leader in digital advertising, further solidifying its financial standing. Additionally, the unveiling of new features on its platforms and advancements in AI-driven advertising strategies have contributed to positive investor sentiment.

However, challenges remain. Increased regulatory scrutiny and concerns about privacy and data handling practices continue to pose risks to the company’s reputation and operational flexibility. Moreover, Meta’s aggressive push into the metaverse raises questions about long-term profitability, which investors are keenly watching.

Future Outlook

Looking ahead, analysts forecast that META’s stock could remain volatile, influenced by both macroeconomic conditions and industry innovations. For instance, if the company successfully galvanizes user engagement through its new ventures and navigates the regulatory landscape effectively, the stock could see substantial gains. On the other hand, any setbacks in its strategic initiatives could negatively impact performance.

Conclusion

In conclusion, the current META stock price serves not only as a reflection of the company’s recent performance but also as an indicator of broader market trends and investor sentiment towards tech giants. As we approach year-end, stakeholders and observers will undoubtedly keep a close eye on META’s developments, as these will have implications not only for the company but also for the stock market at large. Investors are advised to remain informed and consider multiple factors when assessing META’s share performance in the coming months.