Understanding VOO Stock: A Key Player in Investment Portfolios

Introduction

The Vanguard S&P 500 ETF, commonly referred to as VOO, has become a cornerstone for investors looking to gain exposure to the U.S. stock market. As an exchange-traded fund (ETF) that tracks the performance of the S&P 500 index, VOO is a critical investment vehicle for both seasoned investors and newcomers. Understanding its significance in today’s fast-evolving market landscape is crucial for effective portfolio management.

What is VOO Stock?

VOO is an ETF launched by Vanguard Group that aims to replicate the performance of the S&P 500 Index, which includes 500 of the largest U.S. companies across various sectors. As of October 2023, VOO has garnered attention for its low expense ratio of just 0.03%, making it one of the most cost-effective ways to invest in a diversified group of stocks.

Recent Performance and Market Trends

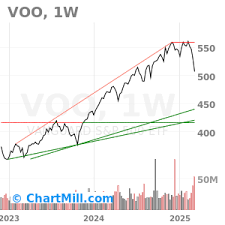

Since its inception in 2010, VOO has consistently offered a strong performance track record, reflecting the overall growth of the U.S. economy. As of last month, VOO’s year-to-date gain stood at approximately 15%, aided by robust corporate earnings and a resilient consumer spending environment. Furthermore, in light of the Federal Reserve’s discussions about interest rate adjustments, VOO’s stability has appealed to investors seeking less volatility amid changing economic conditions.

In the broader context, VOO serves as a bellwether for investor sentiment. With an increasing focus on inflation rates and rising interest rates, the ETF has demonstrated resilience, attracting inflows as investors prefer the reliability of established large-cap stocks when navigating uncertainties.

Investment Implications

For individual investors, VOO offers simplicity and diversification. It enables them to invest in multiple sectors without needing to research and buy individual stocks, presenting a practical solution for those who may lack extensive market expertise.

However, potential investors should consider their investment objectives and risk tolerance levels. While VOO can provide long-term growth, market fluctuations can lead to short-term volatility, prompting a need for investors to maintain a long-term outlook.

Conclusion

Overall, VOO stock continues to play a significant role in the investment strategies of both individual and institutional investors. Its ability to track the performance of the S&P 500 index while offering cost-effective management makes it a favorable option in today’s market. As the landscape continues to evolve, VOO’s significance as a diversified investment remains evident, paving the way for investors aiming for capital growth and financial security.