What to Expect from Inflation in 2025

Understanding Inflation and Its Importance

Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. As economies recover from global disruptions, understanding inflation, particularly projections for 2025, has become increasingly significant. Higher inflation can lead to increased costs of living and major economic implications for businesses and consumers alike.

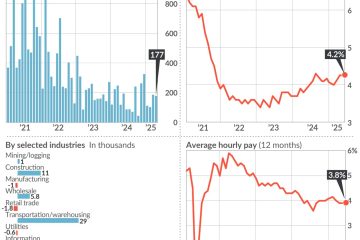

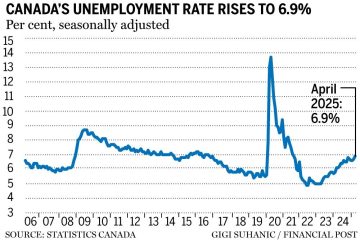

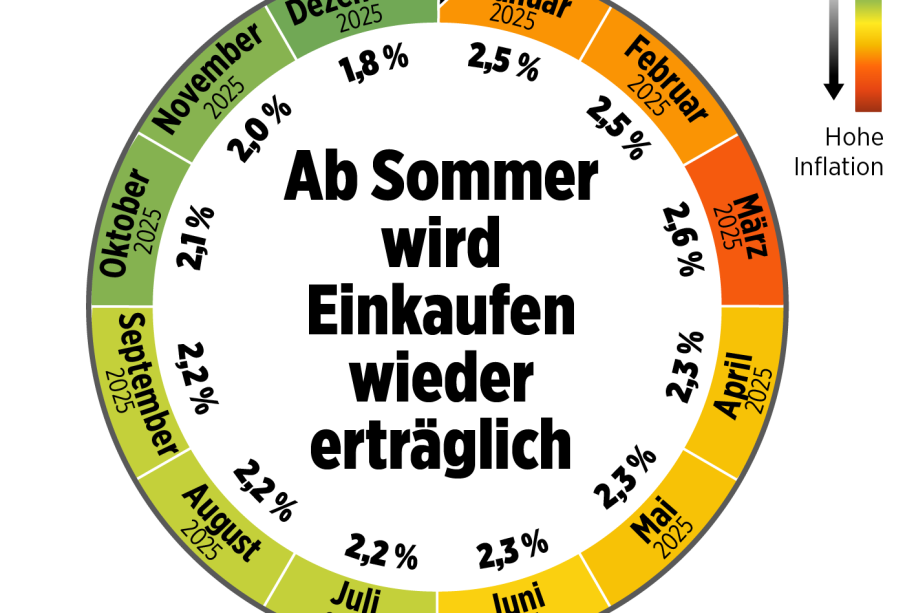

Current Inflation Trends

As of late 2023, inflation rates in Canada have shown signs of stabilizing after a tumultuous couple of years marked by substantial fluctuations. According to Statistics Canada, the annual inflation rate was approximately 3.2% as of September 2023. This figure reflects a decrease from previous highs recorded in 2022, when rates surged above 8%. However, uncertainty about the global economic landscape raises questions about what inflation will look like in 2025.

Factors Influencing Future Inflation in 2025

Several variables will likely shape inflation rates leading into 2025, including:

- Monetary Policy: The Bank of Canada has maintained a cautious approach to interest rates, with many analysts predicting gradual increases to curb inflation. Policy changes can significantly affect consumer spending and investment decisions.

- Supply Chain Issues: Ongoing global supply chain disruptions continue to impact the availability of essential goods. If these issues persist, they would exert upward pressure on prices.

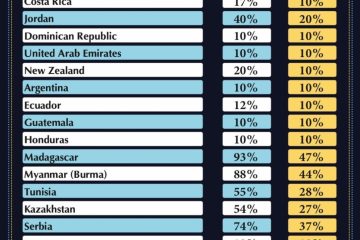

- Geopolitical Factors: Events such as trade conflicts or international tensions can impact commodity prices. Higher oil prices, for example, can contribute to overall inflation.

Predictions for 2025

Economists have varying opinions regarding inflation forecasts for 2025. Some forecast that inflation could stabilize between 2-4%, aligning with the Bank of Canada’s target range. Others suggest it may remain elevated due to persistent supply issues and consumer demand. Consumer Price Index (CPI) analyses will be critical in understanding these dynamics as we approach 2025.

Conclusion: Navigating the Future

Inflation in 2025 is a significant topic for individuals and businesses as they plan financially for the coming years. Keeping informed about trends, government policies, and economic forecasts will be key to making educated decisions. As Canada continues to recover and adapt post-pandemic, consumers and investors must remain vigilant and prepared for potential changes in the inflation landscape.