The Fed Rate: Current Trends and Economic Implications

Introduction

The Federal Reserve’s interest rate, commonly referred to as the Fed rate, serves as a vital tool for regulating the U.S. economy. Recent adjustments to the Fed rate hold significant implications for not only American consumers and businesses but also for global markets. With inflation pressures and economic growth in focus, understanding the Fed rate’s trajectory is crucial for investors and everyday citizens alike.

Current Trends in the Fed Rate

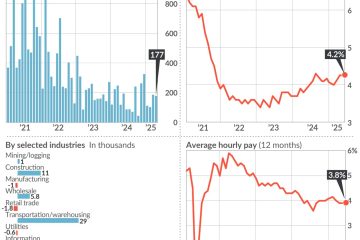

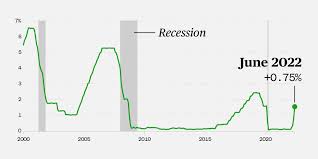

As of October 2023, the Federal Reserve has opted to maintain the Fed rate at 5.25% after a series of rate hikes earlier this year aimed at combating persistent inflation. This decision follows reports indicating that inflationary pressures, while still elevated compared to target levels, are showing signs of moderation. According to the Bureau of Labor Statistics, the Consumer Price Index (CPI) rose by just 3.5% over the past year, reflecting a downward trend.

Notably, economists believe that the current rate level may be nearing its peak as the Federal Reserve aims to balance between fostering economic growth and controlling inflation. Federal Reserve Chairman Jerome Powell remarked in a recent conference that they will continue to monitor economic indicators closely, indicating possible future adjustments depending on the economic landscape.

Economic Implications

The implications of the Fed rate on various sectors are substantial. For consumers, higher interest rates generally lead to increased borrowing costs, impacting mortgages, auto loans, and credit card interest rates. Businesses are also affected as higher rates can lead to reduced capital investment, potentially slowing down economic expansion.

Recent surveys show that consumer confidence has dipped slightly, which analysts attribute to concerns over borrowing costs and overall economic conditions. Conversely, savings rates have seen a slight improvement, as higher rates encourage individuals to save rather than spend, impacting retail sectors.

Conclusion

The Fed rate remains an essential indicator of economic health and trends in the U.S. economy. As the Federal Reserve continues to navigate the fine line between controlling inflation and supporting growth, stakeholders across various sectors must remain vigilant. Economists anticipate that the Fed may hold the rate steady into early 2024, but the unpredictability of global economic factors leaves room for potential shifts. Monitoring the Fed rate will be crucial for consumers, investors, and policymakers alike in the coming months as the economic landscape evolves.