Understanding the Consumer Price Index (CPI) in Canada

Introduction to the Consumer Price Index (CPI)

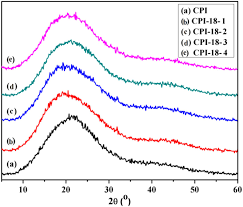

The Consumer Price Index (CPI) is an essential economic indicator that reflects the average change over time in the prices paid by consumers for a basket of goods and services. It is crucial for understanding inflation trends and assessing the overall economic health of a country, including Canada. With rising living costs affecting households nationwide, recent shifts in the CPI have garnered significant attention from policymakers, businesses, and consumers alike.

Current Trends in CPI

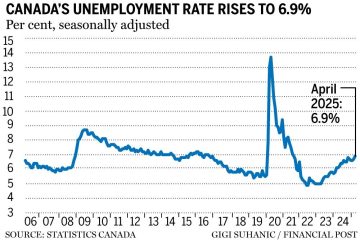

As of August 2023, Statistics Canada reported that the CPI increased by 5.8% compared to the same month in the previous year. This annual increase is primarily driven by the rising costs of essentials such as housing, transportation, and food. In particular, food prices have surged by approximately 10.3%, which has become a pressing concern for many Canadians. Conversely, some sectors, such as electronics, have seen price decreases, reflecting fluctuations in supply chain dynamics.

Furthermore, the Bank of Canada has been actively monitoring the CPI as part of its mandate to maintain monetary policy and control inflation rates. Economists predict that if the CPI continues to rise, the Bank may consider further interest rate hikes to curb consumer spending and address inflation.

Impact on Canadian Households

The implications of the CPI trends are significant for Canadian households. With the cost of living increasing, many families are feeling the pinch, leading to adjustments in budgets and spending habits. The rising costs can disproportionately affect lower-income households, who spend a larger portion of their income on essential goods and services. This means that the burden of inflation does not impact all Canadians equally, highlighting the need for targeted economic supports from the government.

Conclusion and Future Outlook

In conclusion, the Consumer Price Index serves as a vital gauge of economic performance and the financial well-being of Canadians. As inflation remains a critical issue, it will be important for both consumers and policymakers to stay informed about CPI trends and their implications. Analysts predict that the Canadian economy may face further challenges if inflation persists, especially in light of possible interest rate increases. Consumers are advised to prepare for ongoing changes in pricing and consider strategies for managing household expenses as the economic landscape continues to evolve.