Understanding VOO Stock: Current Trends and Market Insights

Introduction

Investing in exchange-traded funds (ETFs) has become increasingly popular among investors seeking diversified portfolios with lower risks. One such ETF, the Vanguard S&P 500 ETF (VOO), tracks the performance of the S&P 500 index. With many investors keen on understanding the market dynamics influencing individual stocks and ETFs, VOO stock stands out as a significant player, reflecting the overall health of the US economy and investment landscape.

Current Performance

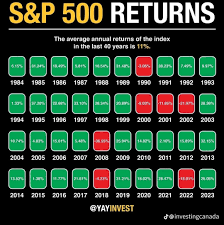

As of October 2023, VOO stock has shown resilience in a fluctuating market, gaining approximately 12% year-to-date. Factors contributing to this upward trajectory include strong corporate earnings reports from major S&P 500 companies, hinting at a robust recovery post-pandemic. Recent reports indicate that despite ongoing inflation concerns, many businesses have successfully navigated supply chain challenges, leading to better-than-expected revenues.

Market Factors Influencing VOO

Several critical factors have been shaping the VOO stock performance recently:

- Monetary Policy: The Federal Reserve’s approach to interest rates significantly influences stock prices. Recent signals from the Fed suggest a cautious stance on rate hikes, which has aided equity markets, including VOO.

- Sector Performance: Technology and healthcare sectors, which hold substantial weights in the S&P 500, have exhibited strong performance. For instance, advancements in artificial intelligence and biotechnology have propelled companies in these sectors, boosting VOO valuations.

- Global Events: International geopolitical tensions have created volatility, prompting investors to seek stability in well-established funds like VOO, which provides exposure to a diverse array of top-performing companies.

Investing Outlook

Looking ahead, analysts remain optimistic about the continued growth potential of VOO stock. Experts argue that even as economic uncertainties persist, the underlying strength of the U.S. economy, coupled with the consistent performance of its largest companies, supports a favorable investment environment. Moreover, VOO’s low expense ratio makes it an attractive option for investors concerned with costs.

Conclusion

The VOO stock represents not just an investment choice but also a reflection of economic trends and investor sentiments. For current and potential investors, keeping an eye on economic indicators, corporate earnings, and Federal Reserve policies will be crucial for making informed decisions. As the market evolves in the coming months, VOO remains a significant player in the investment arena, providing exposure to the broader U.S. equity market while offering a relatively stable growth profile.