An Overview of Capital Gains Tax in Canada

Introduction

Capital gains tax is a significant topic for investors and homeowners in Canada, influencing financial planning and investment strategies. As many Canadians are becoming more aware of their tax obligations, understanding capital gains tax is more relevant than ever, especially with recent legislative changes that impact how these taxes are calculated and applied.

What is Capital Gains Tax?

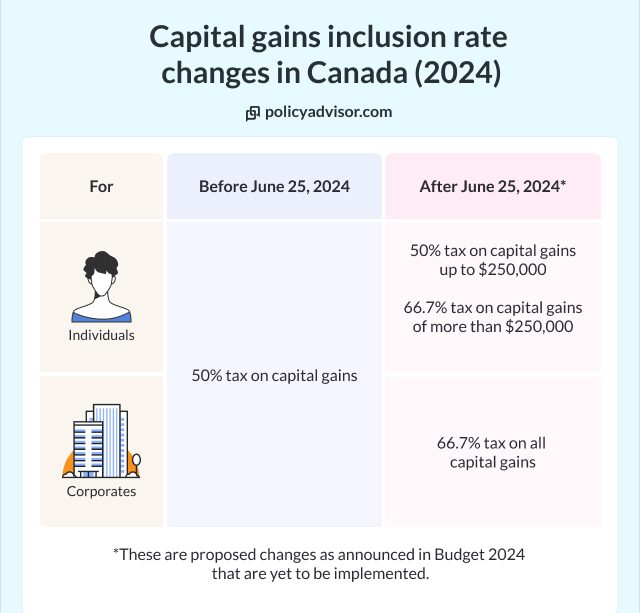

Capital gains tax is levied on the profit earned from the sale of an asset, such as stocks, real estate, or other investments. In Canada, only 50% of the capital gains are taxable. For instance, if an individual sells an asset for a profit of $10,000, only $5,000 would be subject to tax. This approach aims to encourage investment while ensuring that profit from increased asset value is fairly taxed.

Recent Developments

Canada’s capital gains tax laws have seen some adjustments recently, particularly in how they affect real estate transactions. In 2022, the Canadian government introduced measures aimed at cooling the housing market, which included revised reporting requirements for those selling properties. Homeowners must now report the sale of their principal residence to the Canada Revenue Agency (CRA), regardless of whether the sale results in a capital gain being taxed or not. This move has generated discussions among taxpayers regarding their compliance and the timing of future home sales.

Impact on Investors

The capital gains tax is also crucial for investors, especially those involved in the stock market or various investment vehicles. As stock prices continue to fluctuate, understanding when to sell and realizing gains or losses can have substantial tax implications. Investors are encouraged to strategize their buying and selling activities to minimize their taxable capital gains. Tax-loss harvesting, where investors sell underperforming assets to offset gains from better-performing ones, is a common strategy as guided by financial advisors.

Conclusion

In summary, capital gains tax in Canada plays a crucial role in the financial landscape for individuals and businesses alike. With changes in legislation and increased scrutiny on property sales, Canadians looking to navigate this area will need to stay informed about their tax responsibilities. Financial planning and consultation with tax professionals become essential for anyone engaged in asset transactions, with an eye toward minimizing tax liabilities while ensuring compliance with Canadian tax laws.