Understanding the Latest Canada Interest Rate Announcement

Introduction

The Bank of Canada has recently made a crucial interest rate announcement that holds significant implications for the nation’s economy. Interest rates play a vital role in shaping economic growth, consumer spending, and inflation levels. As the central bank adjusts rates to respond to economic conditions, it affects everything from mortgage payments to business investments, making it essential for Canadians to stay informed.

Latest Announcement Details

On October 25, 2023, the Bank of Canada announced that it would be maintaining its benchmark interest rate at 5.00%, unchanged from its previous meeting in September. This decision follows a series of aggressive rate hikes earlier this year, where rates were increased to combat rising inflation, which has shown signs of moderating in recent months.

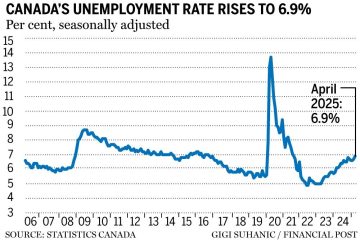

According to the Bank, inflation is currently at 3.3%, a notable decrease from previous peaks, and forecasts suggest it may decline to around 2.5% by mid-2024. The Bank of Canada expressed cautious optimism regarding the economy, citing robust consumer spending and a resilient labor market. Therefore, maintaining the rate was deemed necessary to ensure monetary policy continues supporting economic growth.

Market Reactions and Economic Implications

The announcement has elicited varied reactions from economists and market analysts. Many believe that keeping the interest rate stable will provide much-needed confidence among consumers and businesses as they navigate uncertainty in the global economy. However, concerns remain regarding high levels of household debt and its potential impact on consumer spending.

In the housing market, the rate freeze means that potential homebuyers and existing homeowners with variable-rate mortgages will not face immediate changes to their monthly payments. This could provide a slight reprieve in affordability, allowing for continued market activity.

Conclusion

As the Bank of Canada moves forward, the interest rate decision reflects ongoing efforts to balance economic growth against inflationary pressures. Stakeholders, including businesses and consumers, should closely monitor future announcements as the central bank evaluates economic indicators. Going forward, economists predict that as inflation continues to settle, the Bank may look at possible rate cuts in 2024. However, cautious optimism remains as Canadians await how these conditions unfold in the coming months.