Latest Developments in Netflix Stock Performance

The Importance of Netflix Stock

Netflix, the streaming giant, has made significant waves in both the entertainment and financial sectors. Its stock performance is closely monitored not only by investors but also by analysts due to its influence on market trends. With the ongoing shifts in streaming competition and changing viewer habits, understanding Netflix’s stock trajectory is crucial for making informed investment decisions.

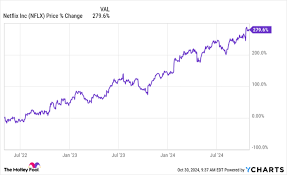

Recent Stock Performance

As of October 2023, Netflix’s stock has seen notable fluctuations. Initially, the stock was trading around $460 per share; however, after announcements regarding new content strategies and subscriber growth, it surged to over $500 per share at the start of October. These developments come on the back of a successful launch of new original series and films, which have drawn considerable viewer attention and engagement.

Subscribers and Revenue Growth

Netflix recently reported a 10% increase in subscriber numbers for the third quarter of 2023, landing at approximately 240 million worldwide. This surge can be attributed to Netflix’s strategy of diversifying its content library to include more international titles and interactive programming, appealing to a broader audience. Furthermore, the company’s revenues also increased by 8% year-over-year, showcasing its ongoing ability to innovate and adapt to market demands.

Market Reactions and Analyst Predictions

The market responded positively to these announcements, with analysts adjusting their stock price targets upward in anticipation of sustained growth. Many experts are optimistic, suggesting that if Netflix can continue to expand its subscriber base and manage costs effectively, it could see its stock price reaching new heights. However, there remain concerns about competition, especially from services like Disney+ and Amazon Prime Video, which are also ramping up their content offerings.

Conclusion and Future Outlook

In conclusion, Netflix stock remains a focal point in both finance and media discussions as it grapples with challenges and opportunities in a competitive market. As the company works to maintain its leading position in the streaming sector, stakeholders will be keenly watching its strategy and performance moving forward. With promising new content on the horizon and innovative strategies being put into place, many investors see potential for significant returns. However, as with all investments, caution is advised due to the inherent risks involved.