Current Trends and Future of Costco Stock

Introduction

Costco Wholesale Corporation, a leading warehouse club retailer, has gained significant attention in the stock market due to its resilient business model and consistent growth. As of October 2023, investors are keenly interested in the performance of Costco stock, especially amid fluctuating economic conditions and evolving consumer behaviors. Understanding the dynamics of Costco stock is crucial for investors looking for stable returns in the retail sector.

Recent Performance

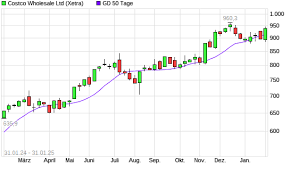

Costco’s shares have shown a robust performance over the past year, with a steady increase that reflects the company’s solid financial health. As of the latest trading sessions, Costco stock is priced at approximately $550 per share, representing a year-to-date increase of about 15%. This growth can be attributed to several factors, including strong sales figures, the successful implementation of e-commerce strategies, and customer loyalty programs that continue to boost foot traffic in their warehouses.

Market Analysis

In Q3 of 2023, Costco reported net sales of $15.24 billion, an increase of 8% compared to the same period last year. Notably, membership renewals have remained stable, with membership fees playing a crucial role in the company’s revenue stream. Analysts project that the company’s strategic focus on enhancing its product assortment and expanding its private-label offerings, known as Kirkland Signature, will further enhance profitability.

Despite global inflation impacting consumer spending patterns, Costco’s value proposition of offering bulk products at competitive prices helps to sustain its market performance. Additionally, the retail giant has effectively adapted to supply chain challenges due to its extensive logistics network and relationships with suppliers, ensuring that product availability remains consistent.

Future Outlook

Looking ahead, analysts remain optimistic about Costco stock as the company continues to leverage its strengths in the fast-changing retail landscape. Forecasts suggest a potential increase in stock value, especially with the upcoming holiday season, where Costco typically sees a substantial spike in sales due to seasonal demand. The company’s commitment to enhancing its online shopping experience could also place it in a favorable position against competitors.

Conclusion

Investors considering Costco stock should weigh its long-term growth prospects against common market fluctuations. With a robust business model that has proven resilient even in challenging times, Costco appears positioned to continue delivering value to its shareholders. As the retail landscape evolves, keeping an eye on Costco’s strategic moves and consumer engagement will be paramount for those interested in the dynamics of this influential stock.