Current Trends in the Canadian Real Estate Market

Introduction

The real estate market in Canada has proven to be a critical topic for homeowners, investors, and policymakers alike. With fluctuating prices, changing demand patterns, and the impact of external economic factors, understanding these trends is crucial for making informed decisions. As Canada moves towards a more stable economy post-pandemic, the real estate sector remains a strong indicator of overall financial health.

Current Trends and Data

As of the last quarter, the Canadian real estate market has exhibited significant shifts. According to the Canadian Real Estate Association (CREA), the average home price in Canada reached $720,000, marking a 5% increase year-over-year. This growth can be attributed to heightened demand in urban areas and a shortage of housing supply.

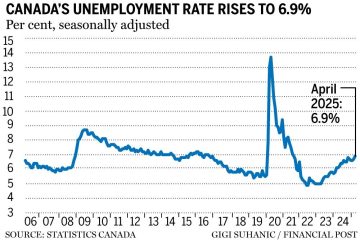

Moreover, interest rates, influenced by the Bank of Canada’s monetary policy, have remained relatively low, allowing more Canadians to enter the housing market. In addition, a recent survey indicated that nearly 62% of first-time homebuyers were motivated by low mortgage rates despite potential economic uncertainty.

The pandemic has also changed the preferences of homebuyers, leading to a surge in demand for suburban properties and larger homes that accommodate remote work needs. Cities such as Calgary and Ottawa have seen notable increases in sales, with buyers looking for more space and affordable options outside major metropolitan areas.

Regions Showing Significant Changes

British Columbia continues to see increased interest, although the housing market in Vancouver has cooled slightly as price growth stabilizes. Conversely, provinces such as Ontario and Quebec are witnessing a competitive market, heavily influenced by immigration policies and local economic growth.

Conclusion

Looking ahead, analysts predict that the real estate market will continue to evolve dramatically. Experts suggest that the demand for housing will remain robust as millennials transition into homeownership and Canada’s economy recovers from the impacts of the pandemic. However, with continued supply challenges and potential interest rate hikes from the Bank of Canada, the landscape may change, posing new challenges for buyers and investors.

Understanding these trends is essential for anyone looking to navigate the Canadian real estate market effectively. Whether planning to buy, sell, or invest, staying informed will be key to making the best choices in this dynamic environment.