Enbridge Stock: Insights and Performance as of 2023

Introduction

Enbridge Inc., one of Canada’s leading energy infrastructure companies, has long been a significant player in the stock market, particularly within the energy sector. With a diverse portfolio of pipelines and renewable energy projects, Enbridge stock remains a vital interest for investors, especially amidst the current volatility in energy prices and market conditions.

Recent Performance and Developments

As of mid-October 2023, Enbridge’s stock price has experienced fluctuations, mirroring the broader energy market trends. The stock opened at approximately CAD 51.20 but has seen both upward and downward movements due to various factors, including geopolitical tensions and changes in energy demand post-pandemic.

The recent rise in oil and gas prices, partially due to ongoing conflicts in oil-producing regions and supply chain disruptions, has positively impacted Enbridge’s revenues. Analysts indicate that the company’s robust earnings report for the second quarter, which showed a net income of CAD 1.5 billion, reflects solid operational performance and resilience in a challenging market.

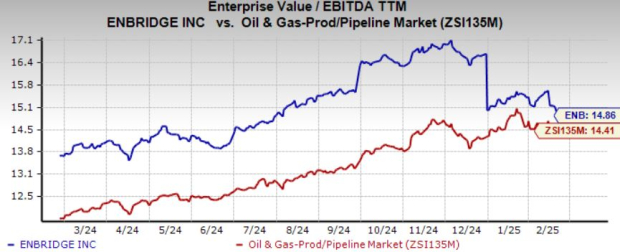

Market Sentiment and Analyst Predictions

Market analysts remain cautiously optimistic about Enbridge stock. A consensus from several financial institutions, including TD Securities and Scotiabank, has set a target price range between CAD 55 and CAD 60 in the next 12 months, attributing this potential growth to continued infrastructure investments and a shift toward greener energy solutions.

In August, Enbridge announced its commitment to invest CAD 14 billion over the next five years into renewable energy, which includes expanding its wind and solar operations. This strategy aims not only to diversify its portfolio but also to position the company favorably as global energy transition becomes a pivotal focus.

Conclusion

Enbridge stock remains a focal point for investors looking for stability and growth in the energy sector. Given the current market dynamics and the company’s proactive strategies toward sustainable energy, there is potential for future growth. However, investors should stay vigilant and informed about fluctuating energy prices and regulatory changes. Overall, Enbridge presents an intriguing option for those interested in long-term investment opportunities within the evolving energy landscape in Canada.