BNS Stock on TSX: Current Trends and Future Outlook

Introduction

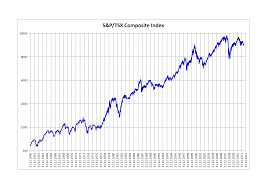

The performance of Bank of Nova Scotia (BNS) stock on the Toronto Stock Exchange (TSX) is a significant indicator for investors, given its position as one of Canada’s major banking institutions. Tracking these trends can provide insights into the broader economic climate and inform investment strategies, especially as the financial sector faces shifting monetary policies and regulatory changes.

Current Market Overview

As of October 2023, BNS stock has experienced notable fluctuations. The share price opened at CAD 85.45 and reached a recent high of CAD 88.60. Market analysts attribute some volatility to concerns regarding interest rates and the anticipated impact on bank profitability. Notably, Scotiabank’s quarterly earnings report, published earlier this month, has revealed a modest increase in profits compared to the previous quarter, with a net income reported at CAD 2.3 billion.

Key Factors Influencing BNS Stock

Several factors contribute to the performance of BNS stock on TSX:

- Interest Rates: The Bank of Canada’s ongoing adjustments to interest rates greatly impact Scotiabank’s loan margins. Higher interest rates generally boost bank profitability but can also slow down loan demand.

- Global Economic Conditions: With Scotiabank having significant operations in Latin America, fluctuations in commodity prices and economic instability in those regions can impact overall financial performance.

- Regulatory Changes: Changes in financial regulations, particularly regarding capital requirements and lending practices, could affect operational capacities and stock performance.

Future Forecast

Analysts generally maintain a positive outlook on BNS stock, projecting long-term growth potential. Forecasts suggest that as the global economy stabilizes, Scotiabank’s diversified portfolio in personal and commercial banking, along with wealth management services, will strengthen its market positioning. However, they also advise investors to monitor interest rate announcements closely, as continued hikes could introduce new challenges for the sector.

Conclusion

Investors focusing on BNS stock on the TSX must remain aware of the current economic trends and market dynamics that influence its performance. While there are signs of resilience, particularly in the bank’s recent earnings, the volatile nature of interest rates and geopolitical factors warrants cautious optimism. Careful analysis and staying informed will be crucial for making sound investment decisions in the coming months.