CVNA Stock: Analyzing Current Trends and Future Potential

Introduction

CVNA stock, which represents Carvana Co., stands at the intersection of the automotive and technology sectors. As a leader in the online used car marketplace, its performance is closely monitored by investors and analysts alike. The importance of CVNA stock has recently taken center stage, especially with fluctuating market conditions and ongoing changes in consumer behavior towards car purchases. Understanding the dynamics surrounding CVNA stock can help investors make informed decisions.

Recent Performance

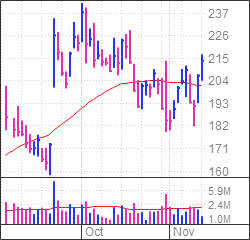

In recent weeks, CVNA stock has demonstrated volatile movement reflecting broader trends in the stock market and the automotive industry. Following a brief surge earlier in 2023, driven by optimism over e-commerce and increasing consumer migration towards online vehicle purchases, the stock has experienced fluctuations due to various factors, including inflation concerns and supply chain challenges. As of October 2023, CVNA stock is trading at around $18, nearing a crucial resistance level that analysts believe could determine its short-term trajectory.

Market Demand and Challenges

One of the major factors influencing CVNA stock has been the demand for used vehicles. According to a report from Autotrader, the pricing of used cars remains elevated compared to pre-pandemic levels, impacting the availability and the purchasing power of consumers. Coupled with rising interest rates, potential buyers’ decisions are becoming more cautious. Carvana has been adapting by revising its inventory management and sales strategies. Nonetheless, analysts have forecasted steady growth for the company as a result of improved efficiencies and a stronger digital presence.

Future Projections

Looking ahead, analysts remain divided on the outlook for CVNA stock. Some believe that Carvana’s unique position as an online-only platform gives it an edge, suggesting that the retailer is well-positioned to capture market share as consumer preferences evolve. However, risks associated with logistics and competition from traditional car dealerships and other online platforms persist. Overall, projections indicate that investors should closely monitor earnings reports and market conditions as they might influence CVNA stock’s performance in the coming quarters.

Conclusion

CVNA stock represents an intriguing yet complex investment opportunity within the rapidly evolving automobile marketplace. As both market dynamics and consumer behaviors shift, understanding these factors will be key for shareholders and potential investors alike. By staying informed about ongoing developments, investors can better navigate the uncertainties that define the stock market today while leveraging opportunities presented by innovative companies like Carvana.