Recent Trends and Insights on BlackBerry Stock

Introduction

BlackBerry Limited, a Canadian company specializing in cybersecurity and software solutions, has been a subject of interest for investors and tech enthusiasts alike. Understanding the performance of BlackBerry stock is crucial, as it reflects the broader trends within the technology sector and reveals investor sentiment towards innovative companies in a rapidly evolving digital landscape.

Stock Performance Overview

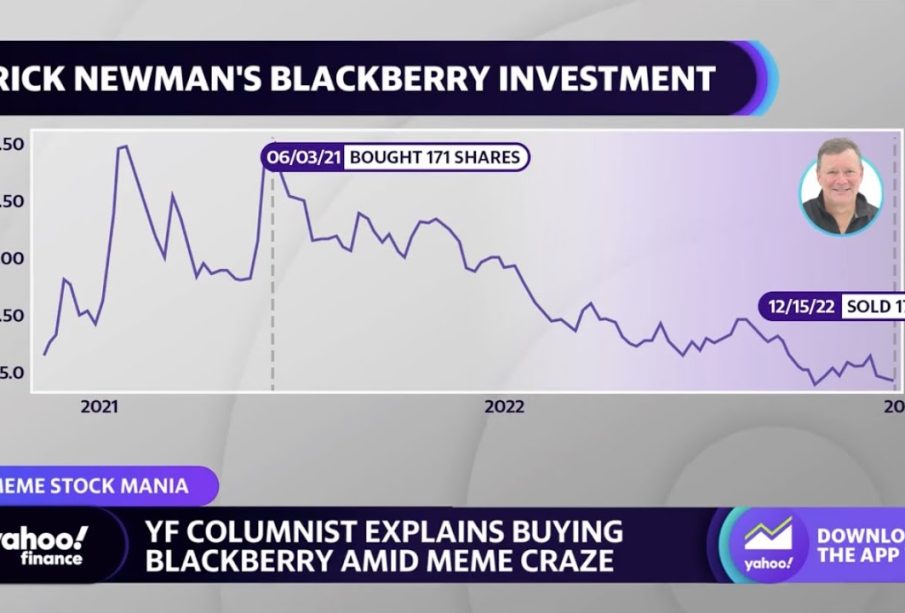

As of October 2023, BlackBerry stock (NYSE: BB) has faced a volatile trading environment, reflecting broader market uncertainties. The company’s stock price has fluctuated significantly, with shares recently trading around $4.20, experiencing a steady decline since its peak in early 2021, when it surged to nearly $28 amid a wave of retail investor interest. This drop can be attributed to the company’s shifting focus from hardware to software, along with broader trends affecting tech stocks.

Recent Developments

BlackBerry is currently concentrating on its cybersecurity and IoT (Internet of Things) solutions, which are expected to be key drivers for future growth. In August 2023, the company announced a collaboration with one of the world’s leading automotive manufacturers, promising to enhance their software capabilities for connected vehicles. This deal is part of BlackBerry’s strategy to penetrate the booming automotive technology sector and may signal a potential turnaround for the stock.

Furthermore, BlackBerry’s quarterly earnings, released in September 2023, showed a slight increase in revenues, but the stock still reacted negatively due to lower-than-expected guidance for the upcoming quarters. Analysts suggest that while the company’s transition may take time, long-term investors should keep an eye on developments in the cybersecurity sector, especially given the increasing emphasis on data security worldwide.

Market Sentiment and Future Outlook

The market sentiment surrounding BlackBerry stock has been relatively cautious. Despite some positive news, investor confidence remains fragile, with many expecting continued volatility. Analysts advise monitoring key performance metrics and industry trends closely, especially in the context of rising competition within the cybersecurity space.

Conclusion

In conclusion, BlackBerry stock continues to be a focal point for those observing the tech landscape in Canada and beyond. While the company has established itself in the cybersecurity sector, overcoming hurdles related to investor sentiment and market fluctuations is essential for stock recovery. Investors should stay informed about the company’s innovations and strategic partnerships, as these factors will be pivotal in determining the future trajectory of BlackBerry stock.