Understanding the Current Canada Inflation Rate in 2023

Introduction

The inflation rate in Canada is a significant economic indicator that impacts the cost of living, purchasing power, and overall economic health. As the country navigates the aftermath of the COVID-19 pandemic and geopolitical tensions, understanding the fluctuations in inflation is vital for consumers, businesses, and policymakers alike. This article provides an overview of Canada’s current inflation rate, the factors driving changes, and its implications for the future.

Current Inflation Rate

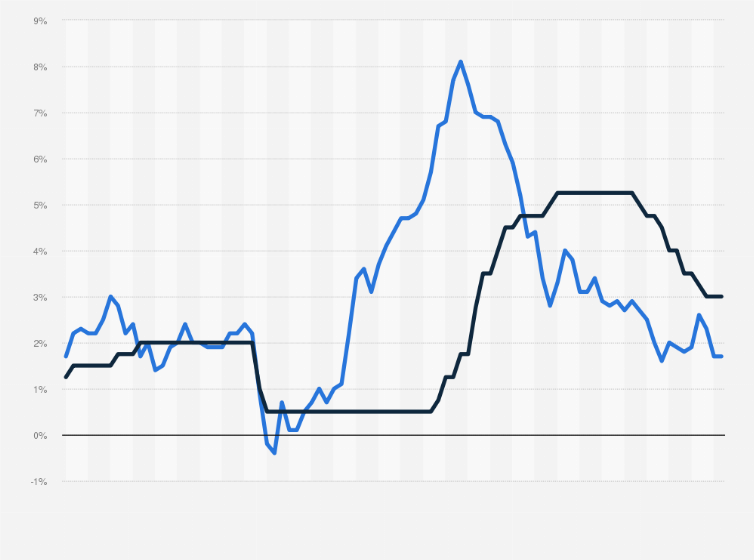

As of August 2023, Canada’s inflation rate stands at 3.8%, a slight decrease from the earlier 4.4% reported in July. Recent data from Statistics Canada indicates that while inflation figures have shown some moderation, they remain significantly above the Bank of Canada’s target rate of 2%. The sustained rise in prices is primarily influenced by increased costs in housing, transportation, and food.

Factors Influencing Inflation

Several factors contribute to the rise in the inflation rate:

- Supply Chain Disruptions: The lingering effects of the pandemic have led to ongoing disruptions in global supply chains, causing shortages of goods and services.

- Energy Prices: Global energy prices have seen volatility, with rising crude oil costs affecting transportation and heating expenses.

- Labor Market Tightness: A tight labor market has led to wage increases in various sectors, which businesses often pass onto consumers.

Recent Developments

In response to these inflationary pressures, the Bank of Canada has been cautiously adjusting its monetary policy. In September 2023, the central bank maintained its benchmark interest rate at 5.0%, a level not seen since 2001, while signaling readiness to further increase rates if inflation does not decelerate as expected. Governor Tiff Macklem emphasized the bank’s commitment to restoring price stability and keeping inflation expectations anchored.

Conclusion

The current inflation rate in Canada reflects a complex interplay of factors, including recovery dynamics post-pandemic and global economic trends. As consumers face rising costs in everyday life, the importance of understanding these economic indicators becomes more pressing. Moving forward, analysts predict that while inflation may gradually decline, it will likely remain above the Bank of Canada’s target for the near future. Monitoring upcoming policy decisions and market trends will be crucial for Canadians navigating this economic landscape.