BABA Stock: An Analysis of Recent Trends and Insights

Introduction to BABA Stock

BABA stock, representing Alibaba Group Holding Limited, has been a topic of considerable discussion among investors due to its fluctuating performance in the stock market. Alibaba, a leading player in the e-commerce and technology space in China, holds significant relevance not only for its market cap but also for its impact on global e-commerce dynamics and Chinese economy health.

Recent Performance and Trends

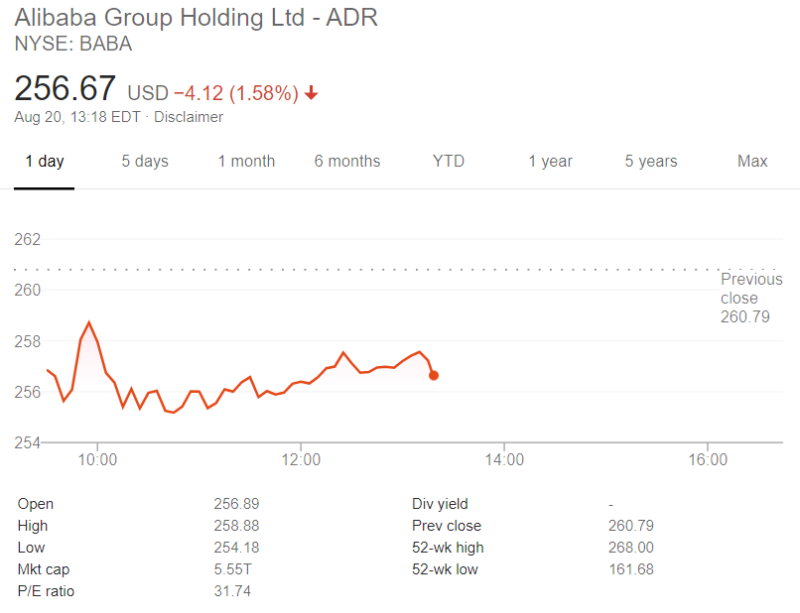

As of October 2023, BABA stock is experiencing a volatile phase. After peaking in late 2020, the stock saw significant declines attributed to government regulatory crackdowns, competition, and broader economic factors affecting China. Recently, however, BABA has shown some signs of recovery, with stock prices hovering around $100, up from a low of approximately $58 earlier this year.

Market analysts have pointed out several reasons behind this bounce-back. Speculations around more favorable regulatory conditions under President Xi Jinping’s administration and the company’s strategic pivot to focus on its cloud computing and logistics services have given investors renewed optimism. In addition, BABA’s recent quarterly reports have presented better-than-expected earnings, further driving the stock’s upward trend.

Investment Insights and Predictions

Looking ahead, analysts are divided regarding the future trajectory of BABA stock. Some experts predict a continued upward trend, citing the potential for growth in e-commerce as digital transformation accelerates, not only in China but globally. Conversely, others believe that regulatory risks and economic uncertainties could hinder progress, urging caution for potential investors.

Investors are advised to keep a close watch on both market trends and government actions in China, as these factors can greatly influence BABA stock’s performance. Furthermore, developments within the company’s international strategy and expansion into new markets can also play a critical role in determining its financial health going forward.

Conclusion

BABA stock remains a significant entity within the tech and e-commerce sectors, marked by its ups and downs throughout 2023. As the landscape for technology stocks in China continues to evolve, BABA presents both risks and opportunities for investors. Staying informed about regulatory changes and understanding market dynamics will be essential for making prudent investment decisions surrounding BABA stock.