Understanding Inflation Trends in Canada: 2023 Overview

The Importance of Inflation

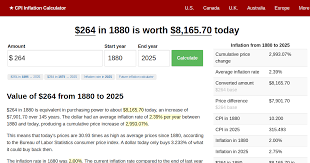

Inflation, the rate at which the general level of prices for goods and services rises, thereby eroding purchasing power, has become a focal point of economic discussions in Canada in recent months. With rising costs affecting everyday consumers and businesses alike, understanding the dynamics of inflation is crucial for making informed economic decisions.

Current Inflation Rates and Trends

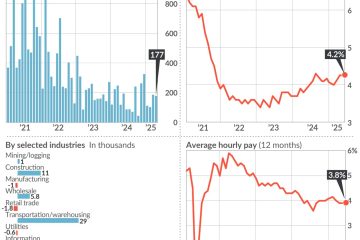

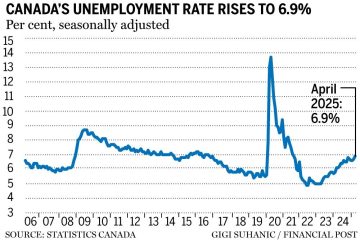

As of October 2023, Canada’s inflation rate stands at 4.2%, a notable decrease from the 6.9% observed earlier in the year. The Bank of Canada has steadily raised interest rates to combat elevated inflation levels, and these measures appear to be yielding results. However, the trajectory of inflation remains uncertain, partly due to external factors such as global supply chain disruptions and ongoing geopolitical tensions.

Key Factors Contributing to Inflation

Several key factors have contributed to the inflationary trend in Canada:

1. Supply Chain Issues: Unprecedented disruptions due to the COVID-19 pandemic have led to increased costs for transportation and production.

2. Energy Prices: Fluctuations in energy prices, particularly oil and gas, have had a considerable impact on overall inflation. With energy costs peaking in mid-2022, consumers have felt the pinch at the pump and in utility bills.

3. Labor Market Dynamics: Labour shortages in various sectors have driven up wages, contributing to increased production costs that businesses pass on to consumers.

Impact on Consumers and Businesses

The impact of rising inflation is being felt by Canadians across the economic spectrum. For consumers, the most significant effects are seen in grocery bills, housing costs, and heating expenses. The cost of living has risen, making it challenging for families to maintain their standard of living. Businesses are also adjusting to inflationary pressures, often having to make hard choices about pricing strategies and staffing. Small businesses, in particular, may struggle to absorb rising costs and maintain profitability.

Looking Ahead: Future of Inflation in Canada

As we move toward the end of 2023, the outlook for inflation remains mixed. Analysts predict that while rates may continue to decrease gradually, many factors including global economic conditions and domestic spending habits could influence the pace of recovery. It is crucial for Canadians to stay informed about these trends, as enduring inflation can impact savings, investments, and overall economic stability.

Conclusion

Inflation is a pressing issue for the Canadian economy in 2023, affecting both consumers and businesses. As the Bank of Canada continues to respond with monetary policy adjustments, understanding inflation’s causes and effects will enable Canadians to navigate these economic challenges more effectively. Monitoring these developments will be essential for planning financial futures amidst an ever-evolving economic landscape.