Understanding CPI Inflation in Canada: Current Trends and Implications

Introduction

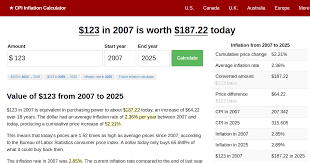

Consumer Price Index (CPI) inflation has become a pressing concern in Canada as it directly affects the cost of living and purchasing power of Canadians. Understanding CPI inflation is crucial for deciphering economic health and making informed financial decisions. As the nation grapples with fluctuating price levels, the relevance of keeping an eye on inflation trends has never been more significant.

Current CPI Inflation Rates

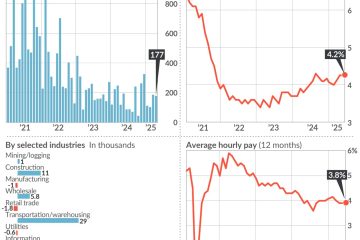

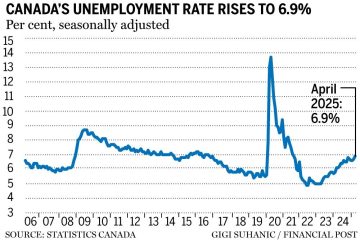

As of August 2023, Statistics Canada reported that the annual inflation rate sat at 6.9%, a notable increase from 3.5% in the previous year. The CPI rose sharply due to escalating prices in essential commodities, including food, gasoline, and housing. For example, food prices alone surged by approximately 9.1% year-on-year.

This continued rise in CPI inflation has implications for the Bank of Canada, which has responded by adjusting its monetary policy. In an effort to stabilize prices, the central bank has incrementally raised interest rates, aiming to contain demand and curb inflationary pressures. As of September 2023, the Bank’s key interest rate stands at 5.00%, the highest level in over two decades.

Sectors Affected

The impact of CPI inflation is most keenly felt in essential sectors. Housing costs, predominantly driven by rent and real estate prices, have steadily increased, with rental prices rising by nearly 7.4% year-on-year. Meanwhile, fuel prices have fluctuated wildly on the global market, contributing to transportation costs that have risen significantly, affecting the prices of goods and services across the board.

Future Outlook

Looking ahead, experts forecast that CPI inflation may gradually decline as supply chain issues resolve and the global economic situation stabilises. However, continued geopolitical tensions and climate-related disruptions could potentially exert upward pressure on prices. Analysts suggest that maintaining vigilance in monitoring inflation metrics will be essential for both consumers and policymakers alike in navigating the future economic landscape.

Conclusion

The significance of understanding CPI inflation in Canada cannot be understated. As inflation affects everything from everyday groceries to housing costs, its trends will continue to shape Canadian economic policy and individual financial decisions. With the Bank of Canada signaling a cautious approach, the hope remains that inflation levels will stabilize, allowing Canadians to regain confidence in their economic stability.