The Canada Pension Plan: A Pillar of Retirement Security

Introduction

The Canada Pension Plan (CPP) is a cornerstone of retirement income for millions of Canadians, providing essential financial support as individuals transition into retirement. Established in 1966, the CPP is a social insurance program that ensures the stability and welfare of Canadian retirees. As the country faces demographic changes and an aging population, the importance of understanding and participating in the CPP has never been more crucial.

The Functioning of the Canada Pension Plan

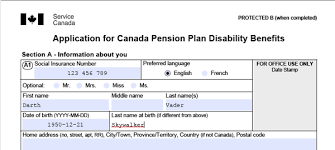

The Canada Pension Plan is funded through contributions from both employees and employers, with premiums collected based on employee earnings up to a certain limit. As of 2023, the contribution rate is 5.95% for employees and employers, totaling 11.9%. These funds are then pooled and invested, allowing for growth over time. Benefits under the CPP include retirement pensions, disability benefits, and survivor benefits, which work collectively to ensure financial security for retirees and their families.

Recent Developments

In 2023, the Canadian government announced an increase in the CPP contribution rates as part of an initiative to enhance long-term sustainability and benefit levels. The aim is to gradually raise the contribution rate from 10.9% in 2023 to 12.9% by 2025. This adjustment addresses concerns about the adequacy of retirement income in light of rising living costs and longevity.

The government also introduced further measures to provide more options for workers, including the option to start receiving reduced CPP benefits as early as age 60, which can offer flexibility for those looking to transition into retirement sooner. These changes are significant as they come at a time when many Canadians are expressing concern over their financial readiness for retirement.

Conclusion

The Canada Pension Plan serves as a vital safety net for Canadians, providing financial support that helps to ensure a dignified retirement. As demographic shifts continue to change the landscape of retirement, it is essential for Canadians to stay informed about the CPP and consider their contributions strategically. With new reforms on the horizon aimed at enhancing benefits, the coming years will be crucial for the CPP’s ability to meet the needs of a growing senior population. As fiscal policies evolve, understanding how these changes impact individual retirement plans will be paramount for future financial security.