Current Trends in Alphabet Stock Price

Introduction

The stock price of Alphabet Inc., the parent company of Google, is a crucial indicator of not only the company’s financial health but also the broader technology sector’s performance. As a powerhouse in digital advertising, cloud computing, and artificial intelligence, understanding the movements in Alphabet’s stock price is vital for investors and analysts alike. Recent fluctuations have drawn significant attention, particularly with the ongoing innovations and economic shifts affecting the tech industry.

Recent Performance

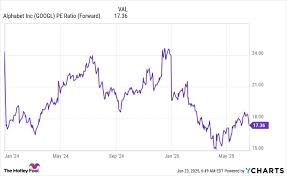

As of October 2023, Alphabet’s stock price has shown resilience despite the volatility in the stock market. Currently trading around $140 per share, the stock has experienced fluctuations due to various economic factors, including inflation fears, interest rate hikes, and shifts in consumer spending patterns. In the last quarter, Alphabet reported a year-over-year revenue growth of 10%, which positively influenced the stock price. Analysts have attributed this growth to increased ad revenues and the robust performance of its cloud services.

Market Reactions and Influences

The tech sector, including Alphabet, has been notably impacted by recent Federal Reserve policies regarding interest rates. Investors remain cautious about potential repercussions on spending. However, recent advancements in artificial intelligence and its integration into Alphabet’s suite of products have generated optimism in the market. This has led experts to predict continued growth for the stock in the long term.

Analyst Insights

Wall Street analysts have mixed opinions about Alphabet’s future stock performance. A recent survey showed that around 70% of analysts maintain a ‘buy’ rating, citing long-term growth potential due to Alphabet’s investments in AI technology and its strong market position. Some believe the stock might face headwinds due to regulatory scrutiny, potentially impacting its growth trajectory. Nevertheless, many consider Alphabet’s diversified business model a strong buffer against market instability.

Conclusion

The fluctuating stock price of Alphabet reflects broader economic trends while also highlighting specific growth areas within the company. For investors, staying informed on Alphabet’s stock price movements and market context is crucial for making informed decisions. As the tech industry continues to evolve rapidly, keeping an eye on Alphabet’s innovations and market strategies will likely reveal further insights into its stock price potential moving forward.