Understanding Current Trends in Mortgage Rates

Introduction

Mortgage rates are a crucial factor for prospective homebuyers and those looking to refinance their homes. With interest rates fluctuating significantly over the past year, understanding current trends in mortgage rates is vital for informed financial decision-making. As of 2023, many Canadians are facing rising rates, which can impact housing affordability, purchasing power, and overall economic stability.

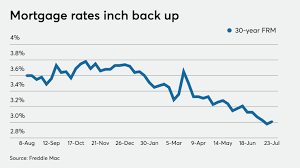

Recent Trends in Mortgage Rates

As of October 2023, the Bank of Canada has raised its interest rates multiple times in response to persistent inflation, pushing mortgage rates to some of the highest levels in over a decade. Fixed mortgage rates have hit averages of approximately 5.5% to 6.1%, while variable rates have also climbed steadily as lenders anticipate further rate hikes. According to data from the Canadian Real Estate Association (CREA), these increases have led to a slowdown in home sales, as potential buyers reassess their budgets and mortgage options.

The benchmark five-year fixed mortgage rate has seen notable changes, moving toward levels that many Canadians have not experienced in years. As a result, first-time homebuyers are finding it increasingly difficult to enter the housing market, evidenced by a decrease in new mortgage applications, which dropped by 11% compared to the previous quarter.

Impact on Homebuyers

The rise in mortgage rates has significant implications for home affordability. Many buyers are opting for smaller homes or seeking properties in less expensive areas to accommodate for the higher payment obligations. Experts recommend that potential homebuyers carefully assess their financial situations and consult mortgage professionals to explore options such as adjustable rates or government-assisted programs.

Conclusion

Mortgage rates are expected to remain elevated as the Bank of Canada continues its efforts to curb inflation. Analysts suggest that prospective homebuyers should stay informed about financial trends and be prepared to act quickly as opportunities arise. The current landscape presents both challenges and adaptations for Canadian consumers, as shifting mortgage rates will greatly influence the real estate market in the months to come. Staying updated on these trends will be crucial for making sound financial decisions moving forward.