Understanding AMZN Stock: Current Trends and Future Predictions

Introduction

The performance of AMZN stock, which represents Amazon.com, Inc., is of significant interest not only to investors but also to the broader economic landscape. As one of the leading giants in e-commerce and cloud computing, the fluctuations of AMZN stock can indicate market trends and consumer behavior. In recent weeks, AMZN has faced various challenges and opportunities, making it essential for investors to stay informed about its current status and future prospects.

Recent Performance

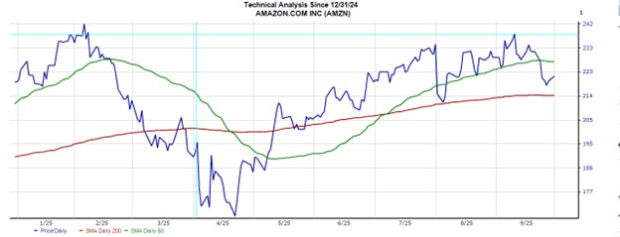

As of October 2023, Amazon’s stock has seen fluctuations influenced by multiple factors, including economic conditions, changes in consumer spending, and competitive pressures. Analysts noted a slight decline in AMZN stock by approximately 6% over the past month, partly attributed to rising interest rates and inflation concerns impacting consumer spending power.

Additionally, Amazon’s quarterly earnings report revealed mixed results, showing a 10% year-over-year growth in revenue but a significant decline in profit margins due to rising operational costs and increased investments in logistics and technology. This has raised some apprehension among investors about the sustainability of its growth.

Key Developments

In response to current market conditions, Amazon is focusing on diversifying its revenue streams beyond e-commerce. The company is investing heavily in Amazon Web Services (AWS), which continues to bolster its profitability. Moreover, the recently launched advertising platform has shown considerable potential, further enhancing its market position.

On another front, Amazon’s recent acquisition of MGM Studios highlights its strategic intent to expand its foothold in the entertainment sector, potentially boosting its Prime Video offerings. This move is expected to attract more subscribers and drive additional revenue, which could positively impact AMZN stock in the long run.

Conclusion and Future Outlook

The outlook for AMZN stock remains a topic of active discussion among analysts. While the current market volatility poses challenges, the company’s deep investments in technology, cloud services, and diversified content offerings may foster resilience and long-term growth.

As consumers adapt to changing economic conditions, so too does Amazon, positioning itself as a formidable leader in several sectors. Investors will need to keep a close eye on upcoming earnings reports and market trends to assess their strategies moving forward. In essence, while AMZN stock may experience short-term fluctuations, its long-term relevance in the global economy remains promising.