Understanding the NASDAQ Composite: Trends and Implications

Introduction

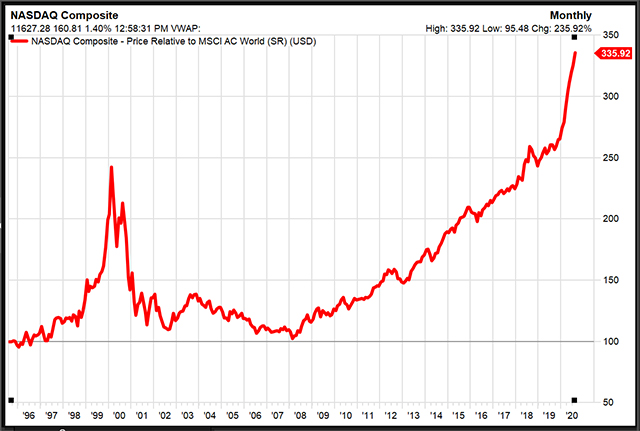

The NASDAQ Composite Index, a key indicator of the performance of technology and growth stocks, plays a crucial role in the U.S. financial market. Comprising over 3,000 companies, it reflects the health of the tech sector and serves as a barometer for investors monitoring market trends. With the ever-increasing significance of technology in our daily lives and economies, understanding the nuances of the NASDAQ Composite has become ever more relevant.

Recent Performance and Key Events

As of October 2023, the NASDAQ Composite has experienced substantial fluctuations, largely influenced by macroeconomic factors such as inflation rates, interest rate hikes by the Federal Reserve, and the ongoing geopolitical tensions affecting global markets. In September 2023 alone, the index saw a drop of approximately 5%, prompted by concerns over slowing economic growth and investor fear of a recession. However, in a surprising turn during early October, technology shares rebounded, particularly in semiconductor and artificial intelligence sectors, leading to a noticeable recovery in the index.

The tech giant Apple Inc., which has a significant weight in the index, announced impressive earnings that surpassed analyst expectations, aiding investor confidence. Furthermore, innovations in AI and cloud computing among firms like Microsoft and Amazon have catalyzed interest and investment in technology stocks, thereby supporting the index’s recovery.

Implications for Investors

For both seasoned and novice investors, the NASDAQ Composite serves as a pivotal tool for understanding market dynamics. Its performance not only indicates the health of the technology sector but also impacts investment strategies across various sectors. Investors should note that while the index can provide prospects for high returns, the inherent volatility also poses risks. Assets heavily concentrated in tech stocks could be sensitive to policy changes or economic shifts, underscoring the importance of diversification in investment portfolios.

Conclusion

The NASDAQ Composite remains a critical indicator of market performance, particularly in the tech sector. As we move further into 2023, investors must stay informed on economic indicators and individual stock performances. With increasing innovations and potential regulatory challenges on the horizon, keeping a pulse on the movements of the NASDAQ Composite can enhance decision-making processes for investors looking to navigate this dynamic landscape effectively.