An Overview of NVDA Stock: Trends and Market Insights

Introduction to NVDA Stock

NVIDIA Corporation (NVDA) has become a focal point in the stock market, particularly due to its role as a leader in the technology sector. The company’s pioneering advancements in graphics processing units (GPUs) and artificial intelligence (AI) have captured investor attention and significantly influenced its stock performance. As of October 2023, NVDA stock is more relevant than ever, reflecting broader trends in the tech industry and the growing enthusiasm around AI technologies.

Current Market Performance

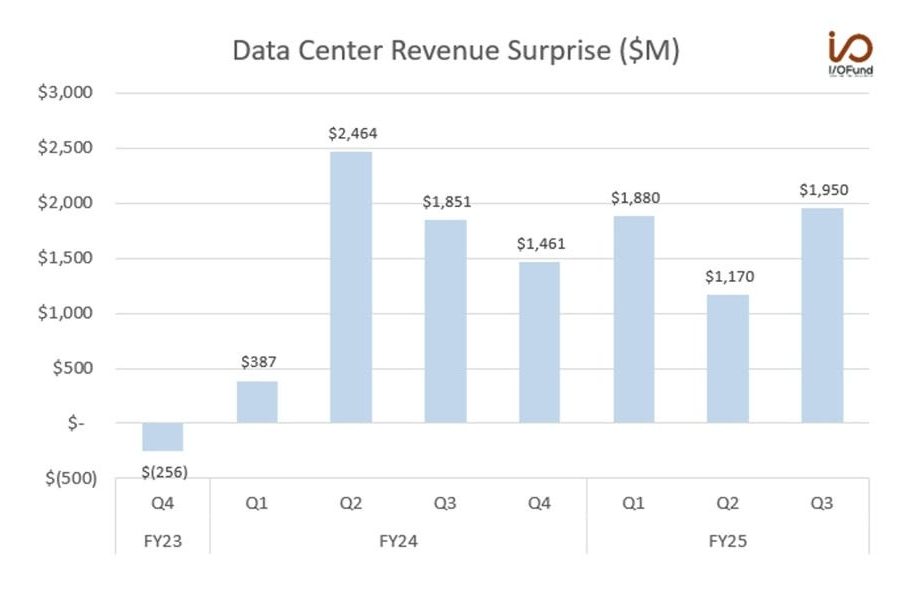

As of the latest trading sessions, NVDA stock has shown remarkable resilience. Over the past year, shares have climbed over 60%, outpacing many of its competitors in the semiconductor industry. This surge has been largely attributed to the robust demand for AI-related functionalities, where NVIDIA’s GPUs have played a critical role in powering data centers and AI applications. Financial analyses indicate that this upward trend is supported by the company’s strong earnings reports, which have consistently exceeded analyst expectations.

Investment Strategies and Analyst Opinions

Industry analysts remain optimistic about NVDA stock, with several major investment firms issuing ‘buy’ ratings. According to a recent report by Morgan Stanley, the firm’s analysts emphasize that NVIDIA is well-positioned to benefit from the ongoing AI boom, predicting substantial revenue growth driven by its data center and gaming segments. However, they also caution investors about potential market corrections due to high valuations and external economic factors like inflation and interest rates.

Future Outlook

Looking ahead, analysts suggest that investors should stay informed about NVDA stock’s performance as the demand for AI technologies continues to expand. The company plans to release new product lines and enhance its existing technologies, which may impact its stock valuation positively. However, it’s crucial for investors to consider the inherent volatility associated with technology stocks and to keep an eye on global economic indicators that can influence market conditions.

Conclusion

In summary, NVDA stock presents a compelling investment opportunity amidst the rapid growth of AI and computing technologies. With its robust market performance and positive analyst outlook, NVIDIA has solidified its place as a leader in the tech sector. Investors should remain vigilant, taking into account both the opportunities and risks associated with investing in a highly dynamic market. As the technology landscape evolves, NVDA will likely continue to be at the forefront, making it a stock worth monitoring for both current and potential investors.