Understanding VOO Stock: An Insight into Vanguard’s ETF

Introduction to VOO Stock

VOO Stock represents Vanguard’s S&P 500 ETF, which provides investors with exposure to the performance of the 500 largest publicly traded companies in the U.S. The relevance of VOO Stock lies not only in its robust investment strategy but also in its cost-effective management fees that appeal to long-term investors looking to participate in the overall growth of the U.S. stock market.

Current Market Trends

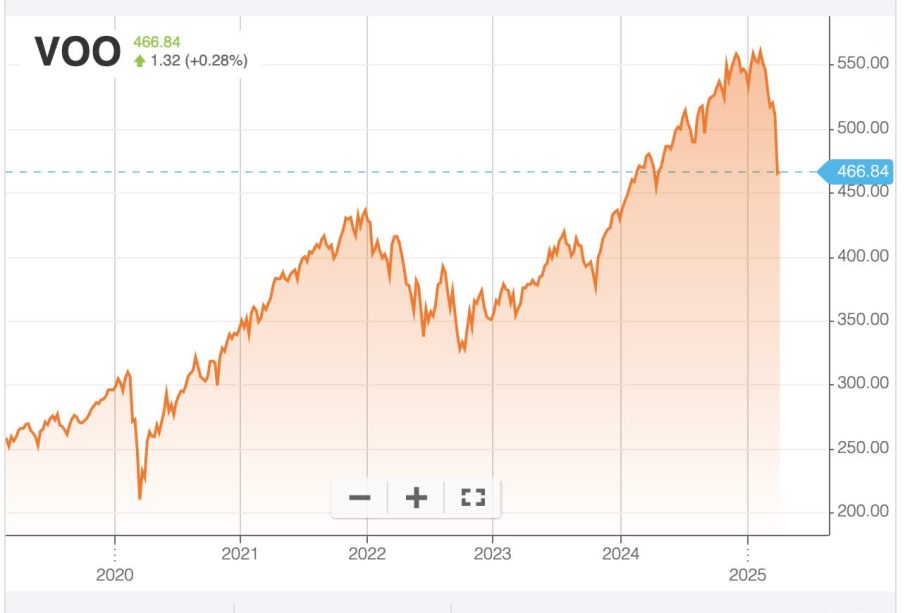

As of October 2023, VOO is trading at approximately $400 per share, reflecting a year-to-date gain of about 15%. The ongoing economic recovery post-pandemic and the resilience shown by major corporations have aided in this price increase. Analysts have noted that despite economic uncertainties, such as rising interest rates and inflation pressures, the fundamentals of the S&P 500 companies remain strong, providing a level of assurance to investors.

Investment Performance

VOO Stock offers a diversified portfolio that reduces individual stock risk while still allowing investors to capitalize on the broader market trends. With an annual expense ratio of just 0.03%, VOO is one of the most affordable ways to invest in the S&P 500. Over the past decade, VOO has provided an average annual return of over 14%, making it an attractive option for passive investors seeking to build wealth over time.

Expert Predictions

Financial experts remain optimistic about VOO Stock’s future performance. According to a recent report from Morningstar, buyers of VOO can expect continued growth, albeit at a potentially slower rate than experienced in previous years due to market saturation. Additionally, as companies navigate the challenges posed by inflation and supply chain issues, companies within the ETF that demonstrate adaptability and innovation are poised to outperform.

Conclusion: The Significance of VOO Stock

For both novice and experienced investors, VOO Stock serves as a pivotal investment vehicle in the world of exchange-traded funds. Its low-cost structure coupled with the potential for capital appreciation solidifies its standing as a preferred option for anyone wishing to engage with the U.S. financial market’s long-term growth. As the economic landscape continues to evolve, maintaining a watchful eye on ETFs like VOO will remain crucial for making informed investment decisions.